There’s no on-size-fits-all for setting up a business, especially for US citizens in the UK. The cross-border US/UK rules are as complicated as can be and you might find yourself the CEO of your own nasty tax bill. Subpart F, Check-The-Box, PFICS, GILTI – we’ve unjumbled the jargon with advice to build you up, not knock you down.

Our experts discuss the personal tax, corporate tax and legal steps for US citizens setting up a UK business:

Speakers:

Scott Barber, Partner at Buzzacott, a top 20 UK accountancy firm based in London, which specialises in US and UK tax, financial planning, business services and audit. Scott has over 25 years’ experience both in the US, his country of birth, and the UK where he has settled, dealing with expatriate tax issues. Scott helps to iron out the complex cross-border tax regulations and is also able to help senior executives working in financial services and owner-managed businesses with temporary or longer-term relocations.

Paul Baker, Director at Buzzacott, works with high-net-worth US citizens, small business owners, partners and US/UK dual qualified charities and foundations. He helps his clients navigate through both US and UK tax systems, to ensure they are not double taxed, through offering proactive cross-border tax compliance services and bespoke personal US and UK tax advice tailored to individual circumstances. Paul is an expert on the US Global Intangible Low Taxed Income (GILTI) regime and its impact on US citizens with Controlled Foreign Corporations (CFCs).

Liam McKeevor, Partner at Buzzacott, is a corporate and business tax specialist advising clients ranging from large international groups and private equity structures to entrepreneurial start-ups. He assists clients on the implications and appropriate structuring for expanding to the UK or growing overseas. He also helps businesses deal with the changing international tax landscape, including advice on transfer pricing, the diverted profits tax and the growing compliance obligations demanded of companies.

Kristin Konschnik is a Partner at Butler Snow, a law firm with practice areas in bankruptcy, construction, labour and employment, tax, immigration, intellectual property, and real estate, among others. She is a US tax attorney advising companies and individuals on the US and international tax aspects of transactional matters, including cross-border sales and acquisitions, hedge and private equity fund transactions, and tax-efficient US inbound and outbound business and investment structures, including partnerships.

Plan your next step If you’re a US citizen living in the UK or you’re planning to move here, there are a number of important life stages you will need to plan for. With a good plan and the right advice, you’ll be ready for any challenge or opportunity life might throw at you while you’re in the UK. Our Stepping Stones series brings together leading advisers from various areas of expertise, to provide you with the need-to-knows for each step of your unique journey in the UK. www.buzzacott.co.uk/stepping-stones

Stepping Stones | US citizens setting up a UK business

25 February 2022 2608 Views

Related Videos

Professional Services Tax webinar – Employment & GES taxes update

BDO UK5808 views 15 November 2023

Is a family investment company taxed differently to a normal limited company?

Bluebond5828 views 24 January 2022

Preparing for a Customs Audit – Do’s and Don’ts

Thames Valley Chamber of Commerce9262 views 24 October 2023

Luke Hanratty interviews Paul Donovan, Chief Economist of UBS Global Wealth Management

Saffery7066 views 21 December 2022

Central banks efforts to curb inflation are starting to pay off

Charles Stanley10728 views 11 September 2023

Grow your Pension, Buy Commercial Property, Invest in your Business.

BusinessTV44538 views 29 January 2024

Financial Reporting – are charity accounts useful | Charity Chats

Shakespeare Martineau3407 views 22 December 2022

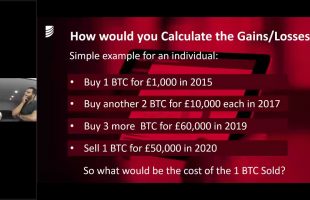

Digital assets Part 2 Corporate and personal tax considerations

Haines Watts6017 views 29 July 2021

A conversation with David Smith – Broadacres Housing Association | BDO

BDO UK6401 views 28 April 2021

Mazars C-suite barometer: Priorities for leaders in 2023 and beyond

Forvis Mazars18545 views 11 August 2023

Search by Topics & Industries

Have You Considered Private Client Insurance?

“Learn How To Say No” – Exporting Tips

What is the UK Export Academy?

The Pensions Regulator – Succeeding with automatic enrolment: Expert insights for advisers

Disputes Nightmares: What would you do if….a senior employee had stolen confidential information?

What comes first, vision or buy-in?

AI in 2024: Implementation, Productivity and Regulation

ABL – Your Best Route to Raising Finance?

Popular

Preparing for Green Reforms: Impact on the retail sector

Mishcon de Reya LLP128807 views 18 July 2024

UK Foodstores: 5 things you should know

Knight Frank117997 views 18 March 2024

Selling Your Business > You’ll need the Right Team in Your Corner

BusinessTV53012 views 11 October 2023

Expert Exporting with the British Chambers of Commerce

BusinessTV48441 views 15 October 2023

Short Dated Government Bonds : An attractive alternative to Cash Deposits

BusinessTV47849 views 5 December 2023

Grow your Pension, Buy Commercial Property, Invest in your Business.

BusinessTV44538 views 29 January 2024

Managing the Proceeds from Selling Your Business

BusinessTV42087 views 1 September 2023

AIM for IHT

BusinessTV39254 views 22 January 2024

Free Financial Guidance and Support for your Employees

BusinessTV39235 views 21 November 2023

Understanding Master Trusts with the Society of Pensions Professionals

BusinessTV32955 views 20 July 2023

Price Increase Management for B2B Companies

Simon-Kucher & Partners31047 views 15 March 2022

Tom Stevenson’s Q4 Investment Outlook

Fidelity UK30276 views 13 October 2022

Retailer pricing strategies

Simon-Kucher & Partners29517 views 31 August 2022

Have You Considered Private Client Insurance?

BusinessTV28504 views 18 October 2024

Planning for retirement – helping employees avoid pension-value destruction

BusinessTV27876 views 20 September 2023

ABL – Your Best Route to Raising Finance?

BusinessTV27783 views 23 September 2023

Promotion effectiveness for consumer goods companies

Simon-Kucher & Partners24895 views 19 August 2022

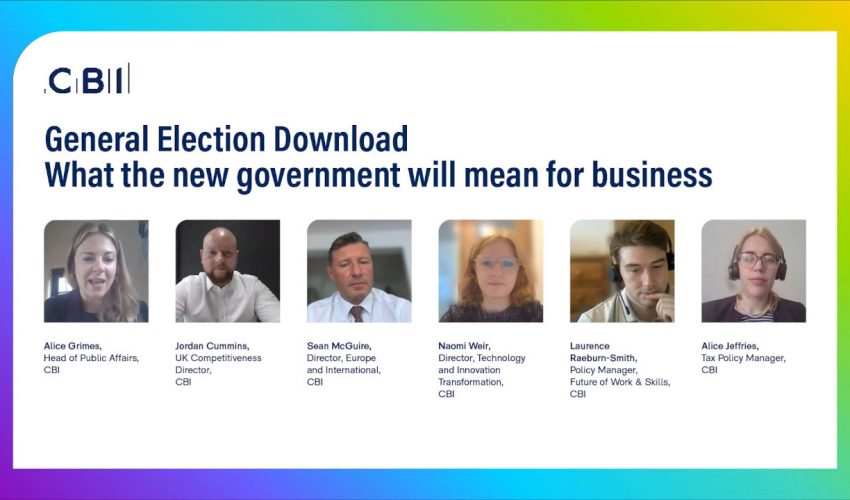

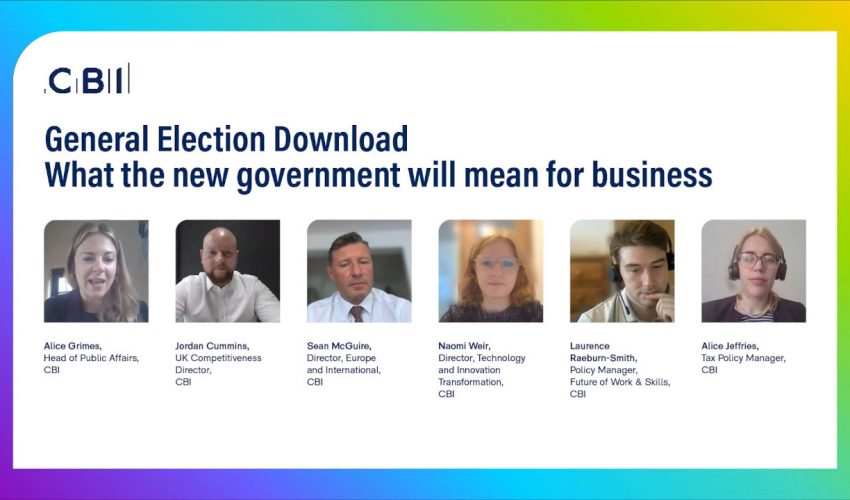

What the new government means for business

CBI24863 views 15 July 2024

The Wealth Report 2022

Knight Frank24454 views 8 April 2022

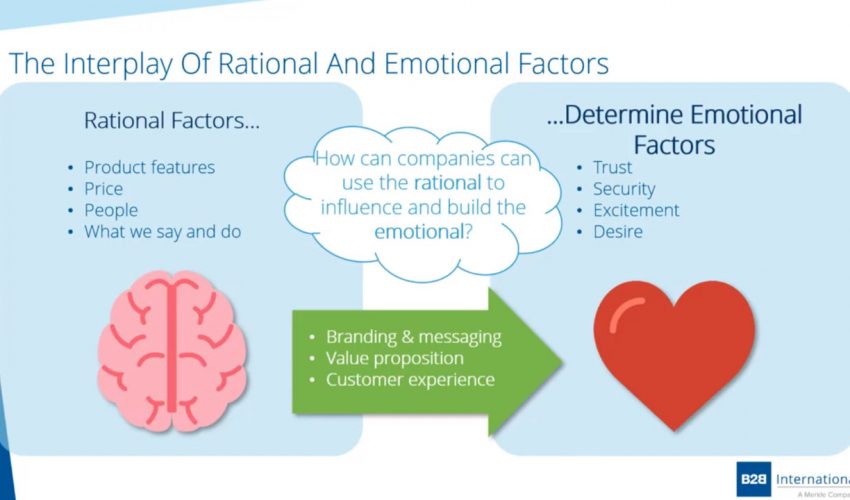

Winning With Emotion: How To Become Your B2B Customers’ First Choice

B2B International Market Research24071 views 1 November 2021

Addressing the legal and tax issues for employers for hybrid and remote working

Ince23975 views 11 November 2022

Looking beyond pay to help employees

Barnett Waddingham23854 views 20 December 2022

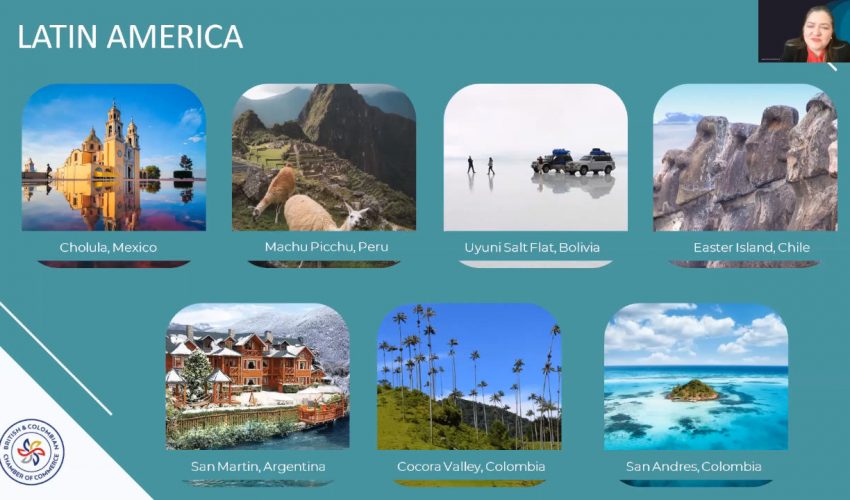

Trading with Latin America

Thames Valley Chamber of Commerce23359 views 20 October 2022

Work-related stress: supporting health and wellbeing at work

ACAS23247 views 10 November 2022

The secrets to successful sustainable marketing

The Chartered Institute of Marketing23099 views 24 August 2022

Employee Benefits: Are you communicating?

BusinessTV22824 views 18 September 2023

*5* ways to future proof your business

Gerald Edelman21961 views 11 March 2024

Introductory webinar: Net Zero for UK businesses

The Carbon Trust21846 views 27 May 2022

Incident responders, solving e-crime through digital forensics & cyber trends

Forvis Mazars21261 views 22 December 2022

The Power of People Reimagined – Workforce reporting transformation

PwC21195 views 16 September 2022

ESG – the intersection with technology and assurance

Forvis Mazars20479 views 2 September 2022

Use EIS To Tax-Efficiently Extract Profits From Your Business

BusinessTV20447 views 2 July 2024

Retail in the Metaverse

Mishcon de Reya LLP20277 views 20 October 2022

Time to talk about mental health at work

ACAS20263 views 17 March 2023

Selling your business? Here are your options

Moore Kingston Smith LLP20219 views 4 August 2022

Ian Stewart, Deloitte UK’s Chief Economist, provides an overview of macro-economic trends

Deloitte20195 views 22 September 2022

London Report 2023

Knight Frank20063 views 15 February 2023

Six Finance Broker Pitfalls to avoid

Causon Business Finance20057 views 11 January 2022

Manufacturing Outlook | Q3 2022

BDO UK20038 views 23 September 2022

Using debt financing to grow your business

Saffery19985 views 7 December 2022

Latest Content

Britain’s manufacturers are stepping up their ESG commitments

Make UK - The Manufacturers' Organisation7619 views 8hours ago

Food breakfast briefing

Mills & Reeve5060 views 10hours ago

The Importance of HR Audits: Ensuring Compliance and Optimisation

Buzzacott3431 views 12hours ago

Generative AI in retail: Insights on consumer behavior

Capgemini8737 views 20 November 2024

Responsible business is good business

IOD4465 views 20 November 2024

Monitoring KPIs under the Procurement Act

Osborne Clarke5725 views 19 November 2024

Dispute Nightmares: What would you do if…are served with a worldwide freezing order?

Mishcon de Reya LLP11657 views 19 November 2024

Employment Rights Bill: key takeaways

Womble Bond Dickinson8932 views 19 November 2024

Women in wealth: The future of high-net-worth

Charles Stanley6035 views 18 November 2024

How to elevate your ESG strategy

KPMG UK2831 views 18 November 2024

Advice for Companies Starting Their Own Ombuds Journey

Centre for Effective Dispute Resolution (CEDR)4539 views 18 November 2024

Common Myths and Misconceptions with Brand Research

B2B International Market Research3473 views 18 November 2024

The Ex Files: Death and Divorce Part 1

Wright Hassall11845 views 15 November 2024

The economics of property

Knight Frank15941 views 15 November 2024

The Future of Building Surveying : RICS Tech Partner Panel Discussion

Royal Institution of Chartered Surveyors (RICS)6207 views 15 November 2024

The growing European cyber insurance market

Willis Towers Watson5232 views 14 November 2024

International business and cross border employment : UK Budget 2024 and legal updates

Moore Kingston Smith LLP9266 views 14 November 2024

Coming Out Ahead in the Energy Transition

L.E.K. Consulting3868 views 14 November 2024

How to avoid IHT on your pension due to changes in the 2024 Budget

Bluebond12445 views 13 November 2024

A Beginner’s Guide to Pension Legislation

The Society of Pension Professionals2904 views 13 November 2024

Killik & Co’s Market Update

Killik & Co4863 views 12 November 2024

How to optimise your supply chain and reduce risk

BDO UK11643 views 12 November 2024

Taking Stock – After The Bell: UK Budget Update

Quilter Cheviot6049 views 12 November 2024

Mind Your Own Business – talking inspiration, purpose and disruption with Cano Water

PwC8869 views 11 November 2024

Shifting attitudes towards protection: The importance of post-sale customer care

Legal & General7113 views 11 November 2024

What are the risks connected with training AI systems

DLA Piper3783 views 8 November 2024

2024 tax changes: what your business needs to know

Bishop Fleming5782 views 8 November 2024

Russ Shaw, London Tech Week: Pull up a Chair with Bina Mehta – Series 3, Episode 2

KPMG UK10270 views 7 November 2024

Our Autumn Budget Review

Killik & Co6238 views 7 November 2024

The Pensions Regulator lays out the direction of DC pensions

REBA - Reward & Employee Benefits Association8236 views 7 November 2024

The Personal Investor Podcast – 2024 Autumn Budget special

Fidelity UK13876 views 7 November 2024

Trading with Japan

Thames Valley Chamber of Commerce8688 views 6 November 2024

Autumn Budget 2024 question time webinar

Kreston Reeves6297 views 6 November 2024

Climate considerations in the financial services industry

KPMG UK3218 views 5 November 2024

Boilerplate in contracts – The Parties

Gowling WLG8298 views 5 November 2024

Family business focus – Autumn budget 2024

Moore Kingston Smith LLP5826 views 4 November 2024

In-depth: Autumn Budget analysis

Make UK - The Manufacturers' Organisation4254 views 4 November 2024

Autumn Budget 2024: Financial Planning

Carpenter Box9495 views 4 November 2024

Autumn Budget: A Personal Tax and Wealth Management perspective

Azets UK6047 views 4 November 2024

Autumn Budget Webinar 2024

Saffery14308 views 1 November 2024

UK Autumn Budget 2024: Key takeaways

Forvis Mazars18265 views 1 November 2024

Adapting to modern work dynamics

Michael Page UK5328 views 1 November 2024

The Future of Computing Might Not Be What You Expect

Gartner8487 views 1 November 2024

Beyond the Budget: Understanding Autumn Budget 2024

MHA MacIntyre Hudson12595 views 31 October 2024

Capital allowances: Real estate – Structure and Building

RSM UK3455 views 31 October 2024

The EU AI Act Explained: What You Need to Know

Osborne Clarke5095 views 31 October 2024

Strategic insights into current employee expectations & how employers are responding

BDO UK9363 views 31 October 2024

Tailored de risking for smaller pension schemes

Legal & General13681 views 30 October 2024

Market Moves October 2024

Charles Stanley5697 views 30 October 2024

Procurement and Supply Models Explained

Chartered Institute of Procurement and Supply (CIPS)3492 views 29 October 2024

Autumn Budget: An R&D and Corporate perspective

Azets UK9598 views 29 October 2024

Deliberate tax

Moore Kingston Smith LLP11424 views 28 October 2024

Brooks Macdonald market Update – October 2024

Brooks Macdonald6897 views 28 October 2024

Employers’ appetite for pensions change

REBA - Reward & Employee Benefits Association11120 views 28 October 2024

AI Complexity Is Growing — Here’s What You Need to Simplify

Gartner8471 views 25 October 2024

Retail hot topics webinar

BDO UK18278 views 25 October 2024

Tokenisation of intangible and real-world assets

IOD6344 views 25 October 2024

Financial scams, part 1 – why it could happen to you

Killik & Co10552 views 24 October 2024

Sustainability is a strategic opportunity for businesses

Simon-Kucher & Partners5829 views 24 October 2024

Liability clauses & insurance policies

Mills & Reeve4550 views 24 October 2024

Exploring the Role of Leadership in a High Performance Team

Duncan Toplis3654 views 23 October 2024

Succession planning; people and tools

Larking Gowen9746 views 23 October 2024

It’s all about AI: But how and why? – Tech Index 2024

DLA Piper7723 views 22 October 2024

The Best Frameworks to Develop Winning Propositions

B2B International Market Research8573 views 22 October 2024

Autumn Budget 2024: An Employment Tax and VAT perspective

Azets UK12916 views 21 October 2024

Mediation at Work: Resolving Conflict Together

ACAS3896 views 21 October 2024

Have You Considered Private Client Insurance?

BusinessTV28504 views 18 October 2024

Accelerating growth through acquisition – FD Webinar part 4

Menzies16922 views 18 October 2024

Why your business strategy needs flexibility

IOD15617 views 17 October 2024

Cyber security for start-ups

Mishcon de Reya LLP6215 views 17 October 2024

Stealth tax?- Wealth tax?

Brooks Macdonald9650 views 16 October 2024

Are you ready for VAT on school fees?

Moore Kingston Smith LLP8425 views 16 October 2024

The Great Wealth Transfer

Quilter Cheviot3604 views 15 October 2024

Investment Outlook Q4 2024

Fidelity UK16250 views 14 October 2024

Building Supply Chain Resilience

BDO UK5148 views 14 October 2024

How brands can disrupt consumer healthcare decisions

PwC4918 views 11 October 2024

Looking to leave a lasting legacy?

Killik & Co16612 views 11 October 2024

Contracting with EU Customers

British Chambers of Commerce12450 views 11 October 2024

Potential UK and US tax changes in 2025 and beyond

Mishcon de Reya LLP8881 views 10 October 2024

Preparing for Autumn Budget 2024

RSM UK14311 views 9 October 2024

The employment landscape post the General Election

HR Solutions11358 views 9 October 2024

Navigating career growth and mental health challenges

Crowe UK9023 views 8 October 2024

BSI Flex on net zero planning for SMEs Views from the user community

British Standards Institution (BSI Group)6292 views 8 October 2024

The Do’s and Don’ts when implementing an AI policy

DLA Piper6130 views 7 October 2024

Market Moves

Charles Stanley3303 views 7 October 2024

What could the Autumn Budget mean for your money?

Hargreaves Lansdown15731 views 4 October 2024

Relocation from the UK

Moore Kingston Smith LLP4329 views 3 October 2024

Who will be the retail winners in a growth challenged environment?

KPMG UK8934 views 2 October 2024

Interests and Positions in a Dispute

Centre for Effective Dispute Resolution (CEDR)10091 views 1 October 2024

Employment Contracts: frequently asked questions

ACAS5356 views 30 September 2024

Basel 3.1 final policy published

Forvis Mazars4504 views 27 September 2024

Effective Communications

IOD11586 views 27 September 2024

VAT on school fees – what should independent schools do now?

Larking Gowen7521 views 27 September 2024

People matter: Carer’s leave

Mills & Reeve3965 views 26 September 2024

Transformative ESG Compliance: CSRD and Beyond

Capgemini8732 views 26 September 2024

Why startup-corporate collaborations can propel market disruption

EY UK&I12167 views 25 September 2024

Tax Takes for Midlife Savers: Managing Capital Gains Tax, Pensions and Inheritances

Killik & Co16966 views 24 September 2024

What is the Brussels effect and does it apply to the EU AI Act?

DLA Piper8494 views 24 September 2024

Introduction to capital allowances

RSM UK9812 views 23 September 2024

How will an IPDI save inheritance

Bluebond14337 views 23 September 2024

Managing ESG litigation risk – derivative actions

Gowling WLG8342 views 20 September 2024

Will AI stop misinformation?

Deloitte4811 views 20 September 2024

Taking Stock – After The Bell: Cracks in the economy

Quilter Cheviot5803 views 19 September 2024

Later Life Lending: How advisors can enhance their skills

Legal & General10584 views 19 September 2024

What are the key differences between a liquidation and an administration?

Menzies5270 views 18 September 2024

Residential Apprenticeship Programme

Make UK - The Manufacturers' Organisation11804 views 17 September 2024

2024 Superpowers Index: Deep-Dive Into the Latest Findings

B2B International Market Research8770 views 16 September 2024

Killik & Co’s Market Update:

Killik & Co8779 views 12 September 2024

CharitEpulse trust in the sector is up!

Moore Kingston Smith LLP6531 views 12 September 2024

Market Update Q3 2024

Gardiner & Theobald8718 views 11 September 2024

Panel Pioneering the future of artificial intelligence

DLA Piper9347 views 10 September 2024

An overview of research & development (R&D) tax relief

Azets UK11955 views 10 September 2024

Client-centric Solutions: Creating Trusting and Lasting Financial Support

Legal & General12997 views 9 September 2024

The importance of the Quarterly Economic Survey

Thames Valley Chamber of Commerce5755 views 6 September 2024

National Minimum Wage Consultation Webinar with With LPC Commissioners and industry experts

BDO UK8652 views 5 September 2024

Tax Policy | What to expect under the new government

KPMG UK18769 views 5 September 2024

Financial mistakes, part two – navigating middle age

Killik & Co11795 views 21 August 2024

Social media & the impact of cancel culture on brands

The Chartered Institute of Marketing17138 views 20 August 2024

What could have caused the stock market summer stumble?

AJ Bell8570 views 19 August 2024

Accounts preparation | Academy Accounts Workshop

Buzzacott7449 views 15 August 2024

Tackling the complexities of employment taxes

Azets UK5665 views 14 August 2024

Taking Stock – After The Bell: Volatility Strikes Back!

Quilter Cheviot10522 views 13 August 2024

Advanced analytics

Willis Towers Watson8118 views 13 August 2024

How CEOs Are Investing In AI

Oliver Wyman5682 views 12 August 2024

Understanding National Minimum Wage compliance

Azets UK10306 views 12 August 2024

Building inclusive benefits: what employers should know

REBA - Reward & Employee Benefits Association9811 views 9 August 2024

BEPS 2.0: Considering the right technology response for compliance

KPMG UK8687 views 9 August 2024

Digital Fortress: Incident Response Planning – Lessons from the field

Mishcon de Reya LLP8052 views 8 August 2024

The top generative AI tools – a how-to guide for marketers

The Chartered Institute of Marketing8597 views 8 August 2024

M&A outlook with a new Government in place

Azets UK10640 views 8 August 2024

How to get on infrastructure procurement lists

Department for International Trade13070 views 7 August 2024

UK Skills Policy and Delivery – opportunities for the new government

IOD7896 views 7 August 2024

Protecting your employees from harassment

HR Solutions5335 views 6 August 2024

Technology Contractor Day Rate Guide – Launch Video 1/3

Hays UK & Ireland5825 views 6 August 2024

Killik & Co’s Market Update: 2nd Aug

Killik & Co7833 views 5 August 2024

Creating the Ultimate B2B Experience

B2B International Market Research5472 views 5 August 2024

If we lend money to adult children from a trust, is it tax-free?

Bluebond12478 views 2 August 2024

An Introduction to Foreign Exchange trading

IOD8711 views 2 August 2024

The UK election: What does it mean for mid-market private equity

KPMG UK14792 views 1 August 2024

Talking HEds: Redundancies and student contract

Mills & Reeve3893 views 1 August 2024

The 2024 Gartner AI Hype Cycle™

Gartner11948 views 31 July 2024

What is IR35? Here’s what you *NEED* to know!

Gerald Edelman8662 views 31 July 2024

When will the EU AI Act be applicable

DLA Piper6573 views 31 July 2024

Tax control benefits for privately owned businesses

Forvis Mazars10803 views 30 July 2024

International Trade in the Digital era – UK and EU perspectives

Thames Valley Chamber of Commerce11705 views 30 July 2024

Biodiversity Net Gain – How are the new rules changing the landscape?

Gowling WLG6763 views 29 July 2024

Prepared minds – How to think with and about generative AI

The Chartered Institute of Marketing8721 views 29 July 2024

Offering Tangible Value

Legal & General8198 views 26 July 2024

Preparing for The General Product Safety Regulation

Osborne Clarke6483 views 26 July 2024

10 benefits of creating a holding company

Haines Watts12266 views 25 July 2024

Roundtable: Futureproofing Greater Manchester’s built environment

Shoosmiths8418 views 25 July 2024

The Building Safety Act: Current impacts and future directions

Mishcon de Reya LLP11937 views 25 July 2024

Taking Stock – After The Bell: All hail the UK “Dullness Dividend”

Quilter Cheviot4024 views 24 July 2024

Private Capital Pulse: Episode 1 – Energy Transition

DLA Piper8782 views 24 July 2024

UNLOCKING GLOBAL MARKETS: MASTERING INTERNATIONAL TRADE AND E-COMMERCE

British Chambers of Commerce13038 views 24 July 2024

Killik & Co’s Market Update: 19th July

Killik & Co8902 views 23 July 2024

The Road Ahead Webinar Recording – July 2024

Make UK - The Manufacturers' Organisation11471 views 23 July 2024

Is your tech transformation driven by business need or FOMO?

Forvis Mazars6713 views 22 July 2024

UK General Election: Impact on Business Tax

Buzzacott6797 views 19 July 2024

Optimise To Thrive: Managing, challenging and optimising your cost base

BDO UK13121 views 19 July 2024

Consumer outlook mid-year update 2024

RSM UK8722 views 18 July 2024

Boost your pension potential

Hargreaves Lansdown9763 views 18 July 2024

Preparing for Green Reforms: Impact on the retail sector

Mishcon de Reya LLP128807 views 18 July 2024

The 3 Types of Early GenAI Adopters

Gartner9536 views 17 July 2024

How to Achieve World-Class Quality in B2B Market Research

B2B International Market Research11907 views 17 July 2024

How does HMRC know the value of my estate when I die

Bluebond11940 views 16 July 2024

The Current HealthTech Landscape, Why Do We Need To Crack Interoperability?

BJSS Ltd5258 views 16 July 2024

Coming Out Ahead in the Energy Transition

L.E.K. Consulting7090 views 16 July 2024

Salaried member rules for LLPs

Saffery6516 views 16 July 2024

What the new government means for business

CBI24863 views 15 July 2024

How to make an effective financial gift

Killik & Co9391 views 15 July 2024

Infrastructure & Construction: The Untapped Digital Potential

Accenture UK8423 views 15 July 2024

UKRI Grant Audits – Our guide to navigating the process

BDO UK8770 views 12 July 2024

Prepare for the UK CBAM now

KPMG UK8387 views 12 July 2024

Energy transition spotlights: Energy users

Womble Bond Dickinson4338 views 11 July 2024

Financing net zero neighbourhoods in the UK: An integrated approach

Royal Institution of Chartered Surveyors (RICS)5590 views 11 July 2024

Knowing your DC default strategy is the beginning of all wisdom

Barnett Waddingham6235 views 11 July 2024

Access to Finance: Opening doors to Investment in Manufacturing

Make UK - The Manufacturers' Organisation15479 views 11 July 2024

Local and National Briefing on the Q2 Quarterly Economic Survey results

Thames Valley Chamber of Commerce8934 views 10 July 2024

Our reflections on the 2024 General Election result

Killik & Co12117 views 10 July 2024