In this Interview Marc Harris chats with Peter Collier & Martin Tilley of WBR Group to learn about the many benefits of Small Self Administered Schemes (SSAS). These are a highly flexible form of pension arrangement exclusively available to directors of limited companies which come with many impressive advantages, the best known of these is enabling company directors to buy commercial property with the SSAS which can then lease the property back to the business in a tax efficient manner.

Use the Chapter links below to travel to specific places in the conversation

Introduction. SSASs and our guests Peter Collier & Martin Tilley of the WBR Group

Ch 1. An overview of SSASs and who they are for

Ch 2. Buying a commercial property

Ch 3. Making a loan to the business from the funds in the SSAS

Ch 4. Greater investment flexibility

Ch 5. Tax advantages

Ch 6. Why there are not more SSAS schemes

Ch 7. Differences between SIPPs & SSASs

Ch 8. Getting started with a SSAS

Ch 9. Making investment decisions

Ch 10. More about commercial property

Ch 11. Loaning money to the business – Criteria

Ch 12. On-going SSAS management and reporting

Ch 13. Particular advantages of a Defined Benefit SSAS

Small Self Administered Schemes (SSAS)

The Pension Scheme Exclusively for Company Directors

** The text within this document has been auto-generated from the original recording and therefore may contain small inaccuracies.

Marc Harris:

In a nutshell, a SSAS is a highly flexible form of pension arrangement exclusively available to directors of limited companies. They’re easy to set up. They do require some professional governance and guidance, hence speaking to the WBR group, but they come with such an extraordinary amount of features and advantages specifically aimed at you, the company director, that they really are well worth a look.

If you don’t have a SSAS, please stick around for this interview because I think you’re going to find what Peter and Martin have to say are absolutely fascinating. Even if you do have a SSAS, stick around for this interview because the WBR group are able to offer an extra special type of SSAS, which really, in Peter and Martin’s own words, allows the individual SSAS members to turbocharge their pension contributions.

This is a feature that perhaps is of particular interest to some of those who are coming late to the pension contributions game, which I know may well be quite a few of you out there. The WBR group are the UK’s largest independent provider of SSAS services.

They administer some over 4,000 SSAS schemes. Peter is the WBR group’s marketing director. He used to be marketing and strategy director at Brown Shipley Private Bank. He’s fulfilled similar roles at Hurley and Partners, who are a firm that turned into the now Matioli Woods PLC.

Peter himself has been a SSAS client for 30 years. He’s very familiar with their ins and outs. The journey to Peter’s current role at the WBR group began when he was invited to join the board of the company that ran the SSAS in the business that he at that time then exited.

Martin is the WBR group’s chief operating officer. He’s a fellow of the Pension Management Institute. He’s a former chair of the SSAS industry body, the association of member directed pension schemes.

And Martin performs very much a technical and compliance and advisory role to the SSAS schemes there. So between Peter and Martin alone, you are about to enjoy the benefit of nearly 70 years of SSAS Insight and SSAS services.

Peter, Martin, thanks very much for joining us on Business TV.

Peter Collier:

Thank you.

Martin Tilley:

Good to be here.

Marc Harris:

]Would you give us a quick overview of a SSAS and who they are for?

Peter Collier:

Oh yes, so a SSAS, let’s just deal with the initials first, small self-administered pension scheme.

So these are bespoke occupational pension schemes established by a limited company. known in our trade as a sponsoring or principal employer. And their purpose is to provide the time and benefits for the directors and owners of SMEs, small, medium companies, family businesses, entrepreneurial businesses.

They’ve been used for 50 years or so by business owners and for the main purpose of keeping more control over investments, over the administration and the decision making of their pension scheme. Being an occupational pension scheme, you need one thing, you have to have a company, you have to have a limited company. So there’s a selection process. Only those with limited companies can have a SSAS and that rules out at sole traders and partnerships. But what I would say, and I can say this is someone who’s had a SSAS himself since 1987, is no one ever really set up a SSAS to save primarily for a pension. It’s what the SSAS can do for you as a family, for you as a business that determines whether it’s the right way to go about saving for a pension. As far as the SSAS is concerned, pensions are, I suppose some people think that they’re difficult to understand. They’re pretty dull. They’re not the talk of the town when you go to a dinner party. But for a SSAS, it’s really easy to understand. And if I could give you a really simple analogy, that might help. So for your limited company, for your family-owned limited company, you have three things in play.

You have a constitution for that company, which is the Articles of Association. The company is owned by shareholders and it’s run by the directors and in a family. business or SME, the shareholders and the directors are usually the same people.

A small self -administered pension scheme mirrors that in its entirety. Instead of articles of association, we have a trust deed, which is the governing set of rules for the pension. Instead of shareholders, we have members. And instead of directors, we have trustees. And again, the rules of a SSAS are that all the members must be trustees. So you can see that it’s an extension of the business already. And that’s what makes it so interesting for SME.

So really, we’re talking about control here. For our listeners today, directors, owners of family businesses. It’s the control of that business that they. they enjoy, I think that’s what gives them the buzz and controlling their pension scheme is pretty much the same thing because let’s face it, it’s got the likelihood of being one of their largest financial assets during the course of their lifetime, so why wouldn’t you want to control that?

So that’s the self -administered aspect in SSAS, the members of the trustees, they’re joined by people like ourselves at WBR as professional trustees and we help steer the ship in the direction that the members want it to go in and we’re there to make sure that all of the rules and regulations of our regulator, the pensions regulator and HMRC are applied.

The word small is because legislation limits the number of members of a small self -administered pension scheme to no more than 11 but in practice that very rarely happens, the typical size of a SSAS is likely to be two, three, four members and perhaps expanding as other generations of the family then join.

And how are these regulated? Well in the world of financial services you may be forgiven for thinking everything is regulated by the Financial Conduct Authority, the FCA, that’s not the case for SSASs, they’re regulated by a body called the pension regulator which does work.

Marc Harris:

Right well we’re going to get on to the more technical elements of the SSAS in a little bit later on. I’m aware of some of the best known benefits of SSAS, benefits to set them aside from the ordinary pension scheme.

So I’d like to ask you about this if I may. Let’s start with buying a commercial property. This is something that appeals to a lot of people. Can you explain how that works and why that’s possible?

Peter Collier:

Absolutely. I’ll just come back to my outrageous statement at the beginning, which said no one ever set up a SSAS to save for a pension. I think it’s fair to say that the vast majority of SSASs are set up because the business wants to acquire or redistribute a commercial property that it owns.

Let’s say somebody’s operating a business in a town centre. They want to get to an out -of -town location. It’s likely that their accountant will be saying to that business, you could do one of perhaps three things.

The company could own that commercial property. You as directors could own that commercial property as a group or individually. or your pension scheme could own the commercial property. And the advantages of the pension scheme owning the commercial property are numerous.

And therefore, it’s really become probably the default first investment for most SASSs. And the reason why SASSs are set up in the first place. So why would you want to put a commercial property in a SASS?

There are tax reasons. First of all, any gains on the capital value of the commercial property over the time you hold it are going to be tax free. But most importantly, for businesses which will operate out of the commercial property they buy, they will lease that business from the… Sorry, they will lease that commercial property from the pension scheme, paying rent to the pension scheme, the rent is tax deductible in the eyes of the revenue in the company, and the rent rolls up gross in the pension scheme. So there’s no tax to pay. The commercial property may be fairly low -cost investment. It may be high -cost investment. So how do you actually go about buying that property? Well, very simply, you could buy it outright if there’s enough liquidity in the pension scheme, if it’s been running for long enough, you can simply buy it outright. But there are other options, which are the more practical options in real life. So first of all, our SASS can borrow money from a mainstream lender to acquire commercial property. There are rules in place for that, and the most important rule probably to understand is that it can borrow up to 50% of the value of the pension fund to acquire a commercial property.

But it can also buy property in stages. Let’s say, the company already owns the property and wants to put it in the pension scheme for the reasons we’ve discussed. Well, if it can’t afford it in one go, it can buy that property in stages, perhaps by 25% in year one.

And then during the next year, there are contributions made to the pension scheme, which improves liquidity. And there’s some rent coming in from the property. So in year two, it can buy another chunk and so on until over a period of time, it’s actually acquired the whole commercial property.

So, you know, there are numerous purchase options available to our to our SSAS. What can you buy is perhaps the most important question. And just remember here, we’re talking about commercial property. And one of the no -no’s for SaaS is that they cannot. invest in anything residential, that’s a home, an Airbnb, just a normal guest house type arrangement. So we’re talking about offices, we’re talking about shops, warehouses, pubs, leisure facilities, all manner of property deemed to be commercial property, probably the ones you can’t invest in other than residential are those that are likely to give the trustees of the pension fund difficulties in the future, perhaps where for example we’re talking about contaminated land, so an obvious example of that might be a petrol station, a less obvious example and perhaps with a little tongue in cheek might be a nuclear power station.

Marc Harris:

Well the ability to, and so just a couple of takeaways here, important for people to understand, I think, you’re not limited to buying the commercial property in which your business is actually occupying, you can buy any any commercial property out there and again in both cases you can lease the, even if it is a business, a building that you’re occupying, you can lease the commercial property that the business will pay rent to the sales funds to occupy the premises, which is a fantastic benefit, it’s such a good benefit, it almost seems like a slip-up from HMRC, that benefit doesn’t it, I mean it’s so powerful.

Peter Collier:

Well it’s the whole aspect of small self -administered and control and the investment freedoms that go with that, so hopefully it’s not a slip -up, otherwise there’ll be a big blint in the commercial property market coming, but yes I think usually a profile might be a client acquires its own commercial property first, but they do get the taste for perhaps the reliability of the income from commercial property.

And we see many, many clients who invest ferociously in commercial property and have a whole portfolio, not just perhaps the business they operate from, and maybe not the business they operate from at all at the end, that the SSAS is a vehicle for holding commercial property.

Marc Harris:

Yeah, indeed. Start out with the premises you occupy and then if that goes well and you’ve got continued funds in the SSAS that you want to do things with, and you’ve got, as you said, you’ve got a taste for commercial property, you know, go into buy it, buy more commercial property. Let me ask you about loaning money to the business, because that’s also a possibility, isn’t it? Just making a loan to the business from the funds in the SSAS.

Peter Collier:

Yeah, and I know Martin’s going to talk a little bit later about the differences between small self -administered pensioner scheme, SSAS and SIPs, but this is one of the major differences that he’ll talk about because one of the investments a SSAS can make is by lending money back to that principal or sponsoring employer. There used to be some fairly tight regulations on what that lending was for, but they’ve been relaxed considerably and pretty much so long as all of the rules are followed, you can lend money back and you have to say, why wouldn’t you if you’re sitting on substantial cash reserves, substantial investments in your pension scheme and your business is needing short -term finance or it wants to buy a new printing machine or whatever it may be, why not buy it from your pension scheme because the model is really straightforward.

The interest that you pay back to your pension scheme is tax allowable for the company and it rolls up gross with no tax in the pension scheme. So that return on investment is good income for the pension scheme and that’s where your members, your directors, your founders of the business are wearing multiple packs and on this occasion they’re wearing the hat of a trustee who’s saying that’s a good investment for the pension scheme.

But like all of these things, there’s some rules that have to be followed and our role as a professional trustee is absolutely to make sure these rules are followed and we’re rigorous in making sure clients do follow these rules.

So very briefly, it’s not an open-ended loan, it’s for a period of a maximum of five years. The company has to commit to regular capital and interest payments. It’s not to pay when you like and maybe think that you can roll it all up to one payment after five years. It is those regular payments. It’s at an appropriate interest rate and although there are revenue rates, rules, professional trustees like ourselves, and enhance those rules in terms of what interest rates need to be paid, but they are market interest rates, they’re not mates rates, if I could describe it like that.

And most importantly, there has to be a first legal charge over the loan. So it’s not unsecured, it’s taken as a charge, whether that’s over other property that the company owns, or whether it’s a personal asset of the directors.

Marc Harris:

Yeah, I can see that the rigor to which rules needs to be applied in all these circumstances is paramount, and of course that’s one of the key advantages of working with yourselves. I was thinking when you were talking about commercial property, again, you mentioned mates rates, I suppose also when it comes to leasing the property from the SSAS. you’ve got to be leasing those within agreed market value.

Peter Collier:

Well, two things. A. If you buy it from the company, your company has got to be an arms length transaction properly valued by independent surveyor and the lease itself and the value of that lease has to be properly put together as well. So yeah, there are no mate’s rates, but on the other side of the coin, if you do these things wrong, our friends at HMRC would have something to say about that and it’s not unknown for small self -adventure pension schemes to find themselves with unexpected but avoidable tax charges.

Marc Harris:

Sure. So important to work with professional help.

Peter Collier:

But with professionals, do it properly. This isn’t just a blank checkbook for family companies, for SMEs to raid their pension schemes at regular intervals.

Marc Harris:

No, and indeed the advantages are so stellar. Anyway, it would be a shame to muck up such advantages.

Peter Collier:

And for most businesses, they don’t want to do that because we’re going to come on to this later, but this is their family’s wealth that they’re creating.

They’re effectively moving money from their business into their pension fund and hopefully they will cast that on to spouses, to future generations. So this is family wealth they’re talking about and most people are very careful with that.

Marc Harris:

Indeed. Let me ask you about the greater flexibility that one has when it comes to investing the pension funds in various different asset classes, because that’s something that might appeal to many people, isn’t it? Can you explain what additional asset classes might be available to those with SSAS?

Peter Collier:

SSAS is a very flexible pension scheme and offers a wide range of benefits. investments. It also prohibits certain investments, we’ve already discussed one such as residential property, but we’re talking about I suppose a standard fare of investments such as deposit accounts, deposit hubs, investing direct into equities, unit trusts, investment trusts, trusty investment funds, hedge funds, commercial property, we’ve already discussed the loans we’ve discussed.

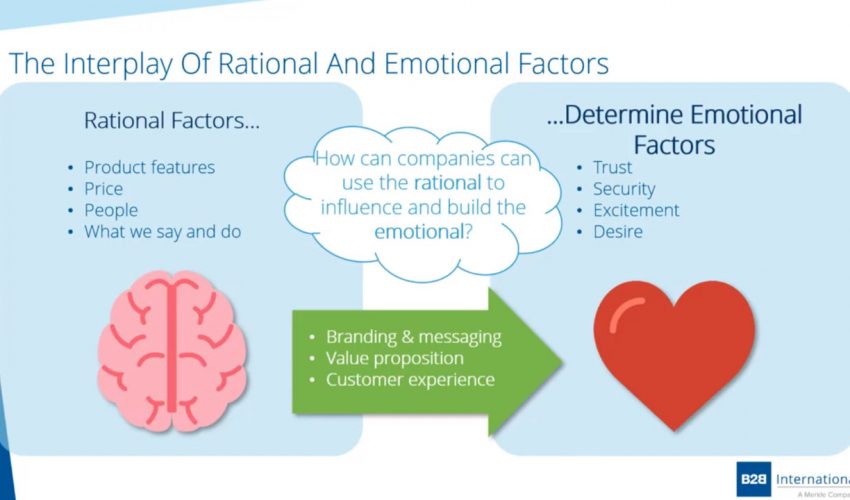

It can also invest in unsecured loans to unconnected companies and even into gold bullion. So there’s a wide range, but I suppose the typical client would have monies invested in cash for liquidity, in some form of basket of equities to provide long-term investment returns and a commercial property. I think that’s how a typical SSAS balance sheet would look like. And you can see from that that you would need to engage a financial advisor or an investment manager to guide you on that. So I think as Martin goes through his talk as well, you’ll see that there’s a cast of characters starting to evolve within SSAS. There’s not only our own role as administrators and professional trustees, and we’ve already talked about surveyors. We’re now talking about financial advisors and investment managers as well. So the SSAS is encircled by professional advisors.

So, yes, the flexibility is generally not unique to SSASs. Its SIPPs also share most of that flexibility, but such as loans back to the employer are unique to SAS. But it’s that control, control over investments. You’re not being pushed into any particular products by a product provider here. You have a completely open architecture opportunity for your investments. And again, that’s appealing to SMEs who want to control that side of their wealth.

Marc Harris:

Are there any specific tax advantages?

Peter Collier:

Well, there are general tax advantages for pensions. I think probably we know a lot of those, but we like to live by the motto at WBR of Live Life Tax Effect Effectively.

That doesn’t mean you live it close to the edge or cross the line. But HMRC offers many, many opportunities for tax reliefs and advantages. Everybody can contribute money into a pension and get tax relief at their appropriate appropriate rates through the WBR. the annual allowance, but with a SSAS for example, when the company pays the pension contributions it will get corporation tax relief on those pension contributions and at the moment that’s risen recently from 19% to 25% and so that’s worth having.

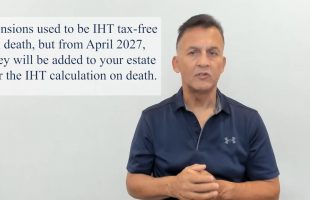

The company will also get corporation tax relief on rental payments on the commercial property and interest paid where there’s thought about the growth within the pension fund is all tax free whether that’s commercial property growth, investment, just pure equity investment growth and of course at the end of your working life or when you come to take those benefits you’re allowed the same tax benefits as anybody else within this defined contribution set up which is perhaps 25% of your fund paid tax-free. So these are the main tax advantages. There’s an interesting word in pensions which is called death benefits. I’m not sure that they’re probably the best words that have ever been chosen but on death there are also opportunities to pass on this wealth within the different rules which today’s talk is not about I think depending on whether death is before age 75 or after age 75 and then finally just like any other defined contribution pension fund passing that on at the moment current legislation allows pension funds to pass on free from inheritance so there are multiple opportunities to be tax effective with SSAS.

Marc Harris:

And if I’m not mistaken assets can be put into trust for future generations can’t they with SSAS?

Peter Collier:

You’re not mistaken because a pension fund is a trust just as any other family trust is so that it’s a wrapper that is holding those assets and I think Martin is probably going to talk a little bit more about how some of those assets can can pass on and how you can involve other members of the family but I suppose simply if let’s take a very simple family of a husband and wife who set up their sass they’re running their own business they have two children when those children reach the appropriate age they join the business and start to work for the business they join the pension scheme and those assets within the pension scheme have this concept of being pulled.

So if we’ve got that typical commercial property cash investment and equity investment, they’re not held just for the benefit of one member, they’re held for the benefit of all of the members in a pooled fund.

So as the children join the pension fund, so they start to acquire a share in the pool of those assets. And I guess one of the benefits is if this company is operating out of its own commercial premises owned in the pension fund, if one of those parents dies, if they own that commercial property individually, then really life would stop whilst probate is granted whilst the commercial property is moved, while stamp duty is paid as the property is moved over. Whereas within a pension fund that property is just sitting there for the benefit of all of the members and on death it doesn’t have to be sold, trading doesn’t have to stop, we don’t have to have new leases, it’s owned by the pension fund still going back to the company as the tenant and the rest of the family carry on their interest in that property.

So it’s a beautiful family trust for cascading benefits down through the generations and of course for those who never need to draw a pension and we see a lot of clients like this, they may never actually draw that pension within the SSAS, they may just through their pension scheme nominations make that available on their death in its entirety to the next generation or the generation beyond. So it is some would say a SSAS is an ultimate family trust.

Marc Harris:

Why are there not more SSAS schemes? Why do more company directors not have a SSAS scheme with so many clear advantages?

Martin Tilley:

That’s a very good question. We ask ourselves all the time there are several million limited companies listed at companies house, relatively few SSASs we estimate somewhere between 45 and 50 ,000. I think it’s twofold a lack of publicity of the features that these vehicles can offer but also quite often a lack of knowledge and they are perceived as being complex vehicles, they are after all occupational schemes not regulated arrangements but if you actually like an onion you peel back the skin they are relatively simple once you understand the main concepts.

There are a number of distributors. of SASSs and they can be direct consumer via an accountant who may see a need for tax purposes from a company or via independent financial advisors. Independent financial advisors are very keen to promote self -invested personal pensions.

Sometimes they are regulated as indeed they are, but they don’t offer the full facilities that a SASS does. So I genuinely believe where you have an SME, small, medium business, family business, SASS should be considered on each occasion.

Marc Harris:

And then concerning SIPPs then, Martin, what is the main difference between a SIPP and a SASS? And are there circumstances where one might be better than the other, which is why SIPs have been so heavily promoted and SASSs have fallen by the wayside as it were?

Martin Tilley:

Yes, there are. There are a number of differences. The first off is that a SSAS is an occupational scheme and requires an employer, whereas a SIPP is a personal arrangement. If you are a partner or self -employed, then a SIPP may be the more appropriate vehicle. I think crucially, SIPPs are offered by FCA -regulated providers and they are very much a product. So they will have features that are set out by the product provider and you really abide by what those SIP provider rules will be.

Some won’t permit you to occupy certain premises. Some won’t even allow you to buy commercial premises, commercial property. SSASs, on the other hand, are individual trusts, individually created by the principal employer and run and governed by the trustees. So whilst they are all still registered pension schemes, the control of a SSAS is very much with the trustees as opposed to having to be controlled, if you like, by the SIPP product provider.

Marc Harris:

What about a scenario, Martin, where you might have sort of three people who’ve got together, they form a company, the company starts to take off, does really well. They’ve all got a SIPP individually and then they all want to have a SSAS. Could they kickstart their SSAS by pooling, by each taking their SIPP and putting it into the SSAS? Is that, is that a sensible question?

Martin Tilley:

Yes, indeed. As I mentioned, they are both registered pension schemes.

So transfers between registered pension schemes are perfectly possible. We would simply have the founder employer create the SSAS trust, contact the SIPP providers, complete a process of due diligence and those are the values of those self -invested personal pensions can then be transferred across to the single SSAS trust.

Marc Harris:

I assume it’s possible for somebody to keep their SIPP. this, the SIPP if they wanted to and also have a SSAS at the same time.

Martin Tilley:

Yes it is, it’s possible to have be a member of a SSAS and a member of a SIPP. I think a SSAS can do pretty nearly everything that a SIPP can do, a SIPP can’t necessarily do everything that a SSAS can do. So if you are intending to move down the SSAS route, consolidating all of your pensions in a single vehicle is probably a good idea. There may be a scenario or two where you would want to keep them separate. SSAS is on multiple members, multiple trustees and as a result of which all of the members do have access and knowledge of everybody else’s entitlement in the small self -administered scheme.

So it might be that purely for confidentiality purposes, a member might want to keep some of their pension arrangements outside of the SSAS rather than pull everything in the single vehicle.

Marc Harris:

You’ve just said we’d also apply to somebody who’s got a previous who’s been working for a company’s got a company pension scheme. I guess the same sort of scenario applies there. It’s a question of judging it on merit.

Martin Tilley:

It does. We see members will come to us with multiple pensions from sometimes multiple different employments. No reason at all why all of those can’t be assessed and if appropriate transferred across into a small self administered scheme. One point we do have to make is that the roles that we fulfill, which is as a trustee and administrator of a pension scheme are not themselves regulated. So WBR group cannot provide regulated advice on whether or not the transfer to a pension scheme is appropriate.

We can simply set out the facts and provide guidance and if necessary an independent financial advisor can be approached to determine whether that’s entirely appropriate for each member.

Marc Harris:

Let’s sort of go through the steps that a client would go through with you to begin their SSAS journey with you and then perhaps as we go we can learn what responsibilities you assume, what responsibilities you don’t assume and how you advise the SSAS members on, I guess, all of those sort of key decisions or how you provide them with information in certain cases to help them make those decisions. Do I take my SIPP? Do I put it into a SSAS? How do we do the commercial property buying? How do we lease that back to the business? How do we get those numbers right? So perhaps we sort of just go through those. I suppose the first thing then is how is money put into the SSAS and are the individuals contributions treated the same and how do individuals members know who has what share?

Martin Tilley:

Okay, I think there’s a number of questions there and the first thing we’d want to go back in terms of a feasibility study with our clients to make sure what they’re wanting to do is entirely appropriate, that they understand the vehicle, understand the responsibilities of the principal employer, the members and the trustees, individuals be wearing different hats at certain times. So we will make them aware of that. But it is very important that there’s a close knit relationship between the client company and the company providing the services to the small self -administered scheme.

So aside of the feasibility, we will then run through the process of creating the SSAS, exactly what they’re going to be wanting to do with it, the levels of contributions they’re intending to pay. It’s far more efficient for the company to pay contributions into the pension scheme rather than pay salary to an individual who then contributes personally because there are national insurance contribution issues both from the employer and employee.

So ordinarily, the company will make a contribution directly into the scheme’s bank account. The scheme’s bank account is controlled by the trustees. And at the point the contribution is made, the company will make it clear to us as the scheme administrator for whom those contributions are intended.

We then have a SSAS operational system which records those contributions and is able to, if you like, split up the contribution on a year by year basis, so that we’re always aware of exactly how much money is held by each individual within the pension scheme. And we report that back to the members on an annual basis.

Marc Harris:

So it can be different amounts of money are held by each individual?

Martin Tilley:

Oh yes, it could be four members start off, a £100 ,000 contribution is paid in, 25% each, but immediately one of those members brings in a transfer value.

They will have a greater proportion of the fund and we will adjust those allocations accordingly, exactly the same way as when benefits are paid out when an individual gets to a date of retirement, then as they pay benefits out of the scheme, their pot gradually reduces and their allocation within the scheme reduces accordingly.

Marc Harris:

I can already see the importance of working with a group like yourselves to make sure all of that process is managed properly and everybody knows exactly how many eggs they’ve got in the basket as it were. And Martin, when it comes to investing, because obviously this is a hugely important component of the SSAS, how are those decisions made? Who chooses where the SSAS invests its money and how do people figure that out?

Martin Tilley:

Okay, well as I’ve mentioned before, WBR are not authorised to provide investment advice, but what we simply can do is provide the guidance to the trustees as to what asset classes are available. The decision as to where monies are made is ultimately with the scheme’s trustees, they are the individuals who control where those monies are invested, so they will unanimously agree that we wish to invest in a commercial property or we wish to invest in a loan back to the company and we can take them through the parameters of how that can be done.

If they’re wanting to invest into other assets, cash hubs, we can help them arrange those. If they want to invest in stocks and shares, well we’re going to be looking to a need to appoint a discretionary fund manager or independent financial advisor. So again the trustees collectively appoint that specialist in that area and then with the other trustees we’ll monitor that with them on a regular basis.

Marc Harris:

Right and important to reiterate something that I mentioned in the introduction that the WBR group, I mean you’re the largest provider of SASS in the country so this is something that you are doing on a very regular basis.

It’s not as if you’ve got one or two SSAS schemes there that you’re helping through these processes. You’re literally dealing with many hundreds or thousands of companies in this situation so things like as you mentioned discretionary asset managers, if they want to be putting their money into certain asset classes, that these are people that you’re already working with and you have an idea of which companies out there might be appropriate for which needs. Let’s go back to the buying the commercial property, because I’m sure that will have ignited a lot of people’s interests for the reasons that so many people get into SSAS is in the first place.

To what extent do you get involved, to what extent can you advise companies or the individual SSAS members about doing this? Is there any time when perhaps it’s not a good idea? And if they do want to, what sort of help and advice can you give there? How involved do you get?

Martin Tilley:

With a commercial property, the first thing that we’d want to do with the members is assess the feasibility, make sure we understand exactly why the property wants to be held and assess whether it can be held within the pension scheme.

A good example might be the purchase of a shop, which within a high street would be generally a perfectly acceptable investment, but it may have a residential flat above it. And even if that residential flat has been sold off on a long leasehold interest, the pension scheme would have an interest in residential property by virtue of the reversionary value of that residential property at the end of the lease and potentially also a ground rent.

Both the reversionary interest and ground rent are taxable, creates a small amount of tax within a pension scheme which can be avoided by splitting the title. So we can actually buy a long leasehold interest of the commercial property into the pension scheme, leaving the residential element outside of the reversion, perhaps with another connected party.

So we will have a discussion with the trustees to make sure we can get the property in there. We’ll also make sure that they are aware of liquidity risk at some point in time, the pension scheme needs liquidity to provide benefits. So it’s always good to think of an exit strategy if you’re interested. that’s necessary. But there’s also an element of managing that property that we’ll want to run through with them. So there could be rental income could be VAT issues, we’d also want to make the building is appropriately insured, and also make sure that it meets the the EPC requirements.

So very much a hand holding through the entire process.

Marc Harris:

And I was going to ask you about about any potential disadvantages with having money tied up in the property. You mentioned liquidity, obviously something that needs to be balanced and thought through carefully.

Insurance. Yes. Are there sometimes issues whereby depending on the level of management that the property needs, if the SSAS doesn’t do that properly, and then they could end up with some sort of liability because there’s been some sort of health and safety issue, which the occupants who are not in the business, they’re not in the business. They’re not themselves as far as I mean, I don’t think disadvantages I suppose I’m asking a of buying commercial property from the SSAS that people should be aware of at least.

Martin Tilley:

I suppose the only disadvantage potentially would be the liquidity issue.

It’s always good to have a plan and this is why this is a long term pension vehicle to make sure there’s liquidity appropriate at various levels. It’s possible for property to be held in multiple ways.

Property can be jointly held between individual members, the company and the pension scheme. And we can also pay out benefits in -species as a proportion of the property. So to some extent liquidity can be managed.

In terms of actual governance, it’s important on day one to work out exactly who’s going to be managing each area of the property. The flexibility of a small self-administered scheme means that the trustees can take on some of those responsibilities themselves.

So if they want to arrange the insurance, if they want to arrange for the rental collection and arrange for the VAT, we’re very happy for them to do that. Alternatively, we can make sure that we can do it. The important thing is to make sure there’s nothing dropping down the gaps between either of us.

Marc Harris:

Another question that just sprung to mind is if you’ve got a portfolio of sort of three and a half thousand commercial properties, you’ve almost got a sort of internal market of those commercial properties between your own SSAS members. Is it sometimes happen that you have a SSAS member who says, I want to buy a commercial property in X and you know one that exists, another SSAS member wants to sell? Does that ever happen?

Martin Tilley:

Strangely, we have had SAS’s where they have been bought and sold by our own clients. Otherwise, we do have to be quite discreet in terms of data protection. So it’s not something that we would knowingly and honestly go around and do. But of course, we do know a number of professional parties. We’re constantly talking to surveyors. We’re constantly talking to accountants. So these things could become known. That’s right.

Marc Harris:

And just another question I wanted to ask you about learning money back to the business, which you mentioned earlier, and you did touch upon it a little bit in your, when I asked you about it earlier, which was the sort of criteria that these loans must fulfill. Would you go into that in any more detail?

Martin Tilley:

Yes. I think one of the key things we’ve got to remember is that we’re a professional trustee, so we’re there to protect the interests of the members and the beneficiaries.

And with a loan, there are two key stages that we need to look at. The first is when the loan is taken out, and the second is whether or not when there may potentially be a default. So as Peter outlined earlier on, there are five key criteria that we have to satisfy for the loan to be treated and accepted by the in-land revenue as a loan.

And that is that the loan cannot be for longer than five years. It mustn’t be more than 50% of the value of the fund. It must be repaid equally with capital and interest repayments. It must be secured with a first charge over a suitable asset and the interest rate must be set at a commercial level.

So as long as we’ve made sure at the point of the loan that all of those conditions are met, the loan is acceptable to the revenue. But we also have to look at the situation and make the members aware that in the event of a default, exactly what would happen with that loan.

So if, for example, a residential property is put up as potential security, we have to make them aware that if the trustees call in that loan, at that point, they would have an interest in residential property and that may be a taxable issue within the pension scheme. So we will talk to the trustees and make sure appropriate security is offered in the unlikely eventuality that the loan defaults.

Marc Harris:

A lot of these issues that we’re talking about, a lot of the advantages of the SSAS, which are fantastic, I can see as more members are part of the SSAS. Inevitably, people are going to have differences of opinions, I suppose, the SSAS members themselves, should we buy a commercial property or not do we loan money to the business? How much potential for people to fall out over issues like that, of course, which is differences of opinions. How are those handled? I mean, is that their business and you don’t get involved? Or are you sort of sat in the middle sometimes offering counsel or offering sort of mediation services? How does that work?

Martin Tilley:

Unfortunately, it does happen and we are involved with the best will in the world. You would even think that the family run business, you should have harmony. 99% of the time you do, with unconnected directors that can be fallouts. The trustees do need to act unanimously and in the best interests of the members. So this is sometimes we simply need to remember remind the individuals that we’re dealing with that they do wear a number of different hats.

They are directors of the business, they are members of the pension scheme, but over and above everything else they are trustees and we need to remind them of their trustees responsibilities and everything else with regard to the pension scheme, those responsibilities should be set aside and focus on the matter at hand.

There are ultimately sanctions, we try not to get that far because what we try and do as the independent trustee is put across an appropriate method of dealing with any conflict. If however the trustees don’t wish to follow that route via the ombudsman and via the pensions regulator, determinations can be made by those parties and in extreme circumstances where trustees aren’t acting in the members best interests they can actually be removed as trustees.

Marc Harris:

Once the SSAS is sort of up and running and it’s made all those principal investments that it wants to do What what does that sort of reporting look like? It just in terms of sheer sort of paperwork that the trustees have to be responsible for.

Martin Tilley:

There are two things that we do need to do if the scheme is two members or more It must be registered with the pensions regulator There’s an annual return and a small levy which we can look after for our clients The bigger role is that of the scheme administrator Which is a role that we also look after for the clients and that revolves around an annual report to HMRC Which is also done online and the length and the depth of that report are largely governed by the complexity and Frequency of transactions within a pension scheme, but again something that we look after for our clients.

Marc Harris:

Because you’re handling all of those decisions and transactions investments that the pension scheme is making So you’ve got that data at hand. It’s not even stuff that you need to ask the trustees for you’ve already got it So you handle all that work for them?

Martin Tilley:

Exactly right. We will be a signatory to the bank account So we will be aware of all of the transactions that are taking place through our SSAS operational system Most of that we’re actually able to collate very simply We used to be able to report actually squirt the data directly from our system directly into HMRC And process more recently and there are now some manual issues that again We look after for our clients

Marc Harris:

How are I know a lot of people will be thinking about this question in their heads as they’re listening to this interview How are the individual members of the SSAS paid out at their retirement if which and of course it’s going to happen people retire at different times or does the SSAS itself have to have a sort of a retirement date that everybody collectively benefits from at the same time

Martin Tilley:

It’s a registered pension scheme so individually are able to draw benefits currently from age 55, shortly to raise to 57, and there’s no requirement to actually retire to actually draw benefits from the pension scheme.

So the rules that govern registered pension schemes enable an individual to draw up to 25% of their fund from the pension scheme and thereafter to take a very flexible income. Now again, this is something that we’d be wanting to plan in advance so that we’ve got the necessary liquidity, but the flexibilities enable each member to draw benefits when they wish at times of their choosing and at rates of their choosing.

So even if an individual draws a tax -free lump sum, there’s no requirement to start an income immediately. And when income does start, it can be varied on a year by year basis.

Marc Harris:

WBR Group are able to offer a defined benefit SASS. And most SASSs is a defined contribution, but you’re able to offer a defined benefit. SASS. And this comes with particular advantages. Can you sort of explain what a game changer this is?

Peter Collier:

Yeah, sure. This is where we get very technical. So I’m going to leave some of the technicalities behind for the purposes of this interview mark and talk in some more generalizations. But just by way of a backdrop, we’ve been talking about SASSs and the vast majority of them are what’s called defined contribution SASSs. That’s to say that your contributions go into a pot and at the time when you come to take your benefits, your benefits are valued depending on what the value of your pot actually is. In a defined benefit world, and perhaps we see these with big final salary schemes, it’s not the how much you put in that is important.

It’s what the benefit is you’ve been promised you can take out, which is the driving factor. And this is where it gets hideously complicated. So first of all, you’re right. WBR Group is able to offer a defined benefit SASS option.

And our chief factory of gentlemen called David Downey is in fact the architect of defined benefit SASSs. And there are not many players in this market because it is very specialist and requires a specialist team of actors to operate it. So what I’d like to do is just perhaps tell a story of a business I used to deal with. And the issues they had was in fact a business run by two ladies. And one of the we were we were good friends. She worked very hard to build her business up. She also had four children, two sets of twins. They were all girls and she came to me probably about five years ago now and said, Phew, you know, I’ve just married the last of my daughters off. I’m in a senior position in my business.

We’re now earning lots of money, lots of good profits, and I’m now in a position to contribute to my pension scheme. The only trouble is I can’t. And I can’t for two reasons. One, because I’m earning too much money and there are restrictions on how much I can contribute to my pension scheme.

And the other is I’m already 57 years old, so I haven’t got enough time to put enough money into my pension scheme to make it to make it worthwhile. And these are real problems for SMEs that in the whether the economy is fluctuating and therefore profits and cash flow are fluctuating, whether the business is building up and can’t afford pension contributions.

The government has restrictions on what you can put in and the annual allowance allows individuals to put in a maximum of £60 ,000 per annum. It was £40 ,000 but now £60 ,000 per annum into a pension scheme.

Now that may seem a lot but if you’re 57 years old you don’t have too many £60,000 worth of contributions before you might want to start taking your pension. So the defined benefit SSAS option that sold all of these problems and if I could use a little marketing line it really turbocharges your contributions into a pension and can get you to a level where you’d like to be to be able to draw some real benefits and it works like this and Mark you’re interviewing me so please stop me if this sounds at all ridiculously complicated.

Marc Harris:

So far I’m with you.

Peter Collier:

So in this DC world you can put in £60 ,000 that’s the benefit that your contribution drives the benefit in the DB world as I’ve said it’s the benefit you want to get out that drives the contribution and this is the thing with this. So the Inland Revenue have a magic number you do not nobody needs to know how this magic number is calculated, but it is 16. The magic number is 16. And the Inland Revenue say that in a DB world, defined benefit world, that’s 60 ,000 pounds when divided by 16 gives you a figure of 3 ,750 pounds.

And that is the pension that you are allowed to save for annually. So in the DC world, you have 60 ,000 pounds as a contribution. In a DB world, per annum, you have 3 ,750 pounds as a pension entitlement.

So our actuaries then say, well, what contribution is needed to deliver that pension? Thank you. And a simple way of looking at it is to go into the annuity market and phone up a product provider and say, how much money at age 65 say what I have to put in to guarantee a pension of 3 ,750 pounds.

And of course, pensions come in all shapes and sizes in the DB world because you can have pensions that escalate with cost of living with inflation. You have pensions, as Martin’s already said, you can draw pensions from age 55, not age 65. And you will want to leave if you have a spouse, you will want to leave a spouse’s pension. And so with actuarial assumptions that are wholly approved by HMRC, we can give you an inflation linked pension. We can let you take it at age 55, and we can give you a 100% spouses pension when you die. And the combination of all those actuarial assumptions means that to fund that pension of 3 ,750 pounds, you will need a contribution, a single contribution of around in today’s terms around 170 ,000 pounds.

So if I could just sort of draw that comparison in the DC world, our SME director can put in 60,000 pounds. Given those assumptions I’ve just given you within the DB world, the company could contribute 170,000 pounds and get corporation tax relief on that of 25%, assuming the business A has the cash flow and B has the profits to relieve the corporation tax.

That is the basis of the DB SSAS. In all other respects, it is a SSAS. It can buy property, and loan money back, and all the things that we’ve talked about. And of course, my friend Liz hadn’t contributed at all to a pension for many, many years.

So not only could she put in 170,000 pounds now, but she can use what’s called carry forward, which is confusing because she can then say, go back three years. And in the previous three years, she could have made contributions. So she can now bring those forward and make them in this tax year as well. And that was when the annual allowance was 40,000 pounds. So she’ll have three lots of 40,000 pounds to divide by the magic number mark, which you can remember is 16. And therefore the end result of that is with all of that carry forward and this year’s contribution, she could get in 500 ,000 pounds or there amounts into her sats in one go. And that in a nutshell is DB SSAS.

There are other benefits, but I feel probably for the purposes of this conversation that’s a good place to pause and see what you think.

Marc Harris:

Just a quick question. Are there any any dis if as you were saying, it can do all of these extra things and all the things that a DC that a standard DC SAS can do. Any disadvantages, any perhaps greater complexity or anything like that?

Peter Collier:

There’s greater complexity? Sorry, sorry, but there’s greater complexity. And that’s why we at WBR group, we have an actual aerial team.

Who support these these products. We have over 350 of them. So then these are not if I may do the dreaded. These are not schemes. These are proper retirement benefit schemes established and registered with HMRC.

I know some people might say, well, define benefit, final salary schemes. The reason businesses are getting out of those is because they can’t afford them because there are big liabilities on big companies. And yes, there are. But these do not provide the DB SSAS does not provide a guarantee pension. It merely provides a target pension. And because you’re the trustee, if for some reason the investment performance and I have to say the the investment assumptions made by the actuaries are ridiculously low, they’re really the guilt the guilty yields.

So it’s difficult to think that there’d be an investment shortfall. But if there was, they can decide whether they want to put more money. money in and the actress will say that’s actually good because that’s an additional allowable contribution but they don’t have to. So there are no liabilities. There is in fact no circumstance where the company would be required under law to pay money into the DB SSAS if there were a shortfall. In fact, if you flip that, the likelihood is there would be surpluses because of very low actuarial assumptions on investment returns and those surpluses can be very useful for bringing new members of the scheme in new members of family and kickstarting their pension but I think that’s where life gets quite technical and I think that’s for another domain.

So there are no there are no disadvantages in terms of setup. It takes the same amount of time it’s taking Martin has probably said already, probably between 12 and 20 weeks or so for HMRC to register a scheme. So there’s some planning needed if you’ve got the sort of typical December or March year ends and you want to get contributions in before those year ends, you need to make sure the scheme is properly established. But other than that, it is a SSAS in all other respects and if I could just finish the story because people might say £3 ,750, that doesn’t seem like a great pension after all of this song and dance.

Well, the reality is that this is just a one-off premium into a DB SSAS. If the company wants to repeat it in future years because it’s cash rich and it wants to put more money away, it can do so that will obviously increase the pension. But what actually happens in practice is that over a period of time, the clients then as they get towards taking benefits are more likely to then take a transfer for which they will need regulated advice and transfer the DB scheme back into the DC environment and take the benefits out of that, which includes 25% tax-free cash and the other things we’ve talked about.

Marc Harris:

So that’s a possibility as well then, one can transfer the DB scheme back into a DC scheme if it’s the right thing to do at the time.

Peter Collier:

Yes, that’s a highly regulated piece of advice but that’s what tends to happen in practice. So you’re turbocharging your pension, you’re holding it in a DB environment and then you’ve either got the option of taking your benefits out of the DB environment, sort of taking them from the DB environment or moving and through a transfer to the DC environment.

Marc Harris:

Well, I think that’s a fascinating advantage because especially in the entrepreneurial world, especially kind of company directors, private, the own companies, it’s so often the case that people don’t start coming into any real money until they’ve been running the business for 10, 15 years.

We all hear stories about amazing startups rocketing to billions of pounds worth of market cap in no time at all. But the reality for most private businesses is it’s a grind, it’s 14 hours a day, it takes at least 10 or 15 years.

And very often one is getting into 45, 50 before one seeing the spoils of all that endeavor. So I think that’s a fascinating advantage. Again, as we speak, it becomes very clear, and I’m sure it’s clear to anybody listening to this, that the working relationship that you have with your clients is absolutely key. And obviously, you’re looking to gather a lot of information, you’re looking to understand where they are at any given point, you know, they’re having to make decisions with your council. What does the scope of your relationship with clients look like? Is there an average amount of time that you’ll spend with a client over a year? Is it a couple of coffee mornings a year or is it a monthly telephone call? More or less, can you give us an idea of what that might look like?

Martin Tilley:

It’s a very close relationship and as I say from day one we look at the feasibility of whether the pension scheme is going to achieve exactly what the goals and targets of the client are but it’s not just a set it up and forget about it, it is an ongoing relationship.

Pension schemes run for tens of years and over that period of time circumstances change and it’s important to keep close to the client so we can make sure that we’re aware of how the circumstances change, how we can adapt what we’re doing, how legislation may change and how the pension scheme may actually alter what the client wants to do and we do this by operating what we call a cradle-to-grave system.

So an individual client manager will be assigned to look after a small portfolio of clients and they will be involved really on a day -by -day basis with all of the administration and in close contact with the client.

We also offer trustees meetings and these are particularly important because these are quite often sit -down meetings where you get far more out of them than you would through a telephone conversation or even a video call and it’s through that close contact we’re able to stay in touch with and help provide the guidance that the clients need to make sure the pension scheme delivers what they want it to.

Marc Harris:

Yeah indeed and the individual trustees themselves should be motivated to get to to get together in those meetings with you and indeed the other members if people are working remotely or whatever because of course as you said it’s always sitting down in those contexts always helpful.

helps everybody thrash through ideas. Peter mentioned earlier, when he was explaining sort of DB schemes, maybe a 20 week period that it takes, that it takes either it was HMRC to recognize the scheme or the pensions regulator to recognize it. I can’t remember exactly. Is that sort of fairly reflective of how long it would take you to set up a scheme for sort of say three individual members who come to you and say look, we’d like to set up a SSAS scheme with you. How long does it take?

Martin Tilley:

Yeah, I think it’s appropriate to manage expectations. The actual process of putting the documentation in place is relatively simple. There’s data collection about the company and about the members.

We can have the paperwork to create a scheme available within just a matter of days. But the problem that we have and where we are out of control if you like is that once the submission is made to HMRC, HMRC will then do their own checks on the company and make sure it’s appropriate to register that pension scheme.

Management of expectations on the best side of things you might see four weeks as Peter has alluded, sometimes it’s as long as 20. So again, important to make sure well in advance of a company financial year that you thought this may be the appropriate vehicle for the client.

Marc Harris:

And then finally, and I don’t know whether this is an appropriate question, but fees, I mean, are fees dependent on the number of individuals who want to join the SASS at the same time or are they dependent on the funds under management? How do they work, broadly speaking?

Martin Tilley:

Yeah, the important thing about this is that no two SASSs are the same and no two SASSs require exactly the same level of connectivity. So we will always meet with our clients and ask them exactly what they want to do with the scheme, how many members will be joining the scheme, whether they’re transferring additional assets in, whether they are then going to buy a property when they’re going to loan back, and we will agree with them an all -inclusive annual fee.

And we think the all -inclusive annual fee is important because we don’t want clients being afraid of contacting us and saying, look, I’ve got this idea, I’d really like to do this without the worry of thinking there’ll be an additional charge for it. So we do reserve the right to review the fees on a three-yearly basis, but genuinely we believe that clients like the certainty of a fixed fee that’s appropriate to their own circumstances.

Peter Collier:

…and Mark, we also have a slightly differing charging structure for DB SASSs as well, which I’ve just spoken about.

So there’s some actuarial involvement in that, but the basis of the charge is the same, but there’s slightly different. different mechanisms in there.

Marc Harris:

Yeah you mentioned when you were talking through those that there’s that actuarial element which all needs to be figured out with this magic number 16. Thank you. Yes I managed to remember that. So thanks very much both of you for taking us through this fascinating topic. I just want to remind viewers that underneath this video as it plays we’ve got loads of links there through to the WBR group. Links to various different deep sections on their website so you can learn more about what they do, who they work with, got some wonderful testimonials there from many many companies who are currently successfully running SASSs with them.

So please go through that go through those links go through that literature to check it out. There’s also a form you can fill out which is directly below the belief of this video. If you want to get in contact with either Peter or Martin in that way, you can do or just pick up the phone and give them a call So all that’s left for me to do is thank you Peter. Thank you Martin very much for taking us to fascinating Subject I can’t think that anybody out there who doesn’t have a SSAS isn’t seriously considering whether one would be right for them or not now So thank you. Thank you very much. Thanks for your time.

Martin Tilley: Thank you

Peter Collier: Pleasure

You may get in touch with Peter or Martin using this short contact form

By submitting this form you confirm that you have read and agree to the WBR Group Privacy Policy

Peter Collier

Director of Marketing and Distribution

Peter is Director of Marketing and Distribution for WBR Group. He fell into pensions in 1997, after being invited to join the board of the company that looked after his SSAS, at the time he exited that business.

Since then, Peter has held senior roles in marketing, business development and strategy within wealth management. He was head of Marketing Strategy at the private bank, Brown Shipley from 2002 to 2012. As Business Development Director at Hurley Partners (latterly Mattioli Woods), Peter was responsible for intermediary and direct sales as well as working on significant corporate projects.

Being a SSAS client for over 30 years, Peter is fully conversant with the product’s benefits and operation. In his time in wealth management he was a regulated adviser and a member of the Securities Institute. He qualified as a Chartered Accountant ‘a long while ago’ and is therefore an FCA.

In his spare time Peter and his wife Melanie look after their small-holding, various animals and orchards, as well as acting as a chauffeur to his daughter! He is a lifelong Spurs supporter and also an avid golf & cricket watcher, and sometimes player.

Martin Tilley

Chief Operating Officer

Martin is a Fellow of the Pensions Management Institute and has spent nearly all of his 37-year career advising on self-invested pensions.

He has held senior roles at specialist Self-Invested Personal Pension (‘SIPP’) and Small Self-Administered Pension Scheme (‘SSAS’) providers as well as at a wealth manager, fulfilling technical, compliance, and advisory functions.

He is a well-known industry spokesperson, writing and presenting education pieces and a former Chairman of the SSAS industry body: Association of Member Directed Pension Schemes (AMPS).

He particularly enjoys the forensic examination of complex SSAS cases and has a pragmatic approach to problem solving with a keen eye for detail. He believes that understanding the client’s needs are key to providing a bespoke service and that SSASs are “not a product.”

Martin is one of WBR’s trustee consultants and will often attend trustee meetings.

Outside of work, Martin enjoys his holidays near and far as well most sports, now mainly as a spectator.

The UK’s largest independent provider of SSAS services

WBR Group are the UK’s largest independent provider of SSAS pension administration and trustee services. We are winners of Best SSAS Pension Provider 2023 at the Investment Life & Pensions Moneyfacts Awards. As your pension fund is or will become one of your largest financial assets, choosing us with our renowned practical expertise and cradle to grave service delivers peace of mind.

- Over 4,000 SSASs

- Traditional DC and Defined Benefit SSAS propositions

- Client assets under administration in excess of £4 billion

- More than 3,500 commercial properties held as investments

- Directors with combined SSAS experience of over 100 years

- Five qualified actuaries

In the short video below, WBR Group’s CEO, Tom Moore, discusses how the group became the largest provider of SSAS services in the UK and their complimentary Tax & Actuarial Services.

Live Life Tax Efficiently: Our tax advisory services offer expert guidance and bespoke strategies to help you navigate the opportunities available through the UK tax system.

![Interest Rate Risk For DB Pensions Schemes | Mind The [knowledge] Gap](https://www.businesstv.tv/wp-content/uploads/2022/05/Interest-Rate-Risk-For-DB-Pensions-Schemes-Mind-The-knowledge-Gap-310x200.jpg)