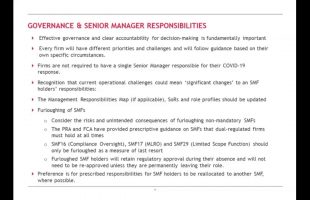

A tax control framework (TCF) is a set of processes and internal control procedures that ensure a company’s tax risks are known and controlled.

It is a step-by-step roadmap for managing tax matters efficiently and transparently, making sure the company complies with its reporting and compliance obligations at both the national and international level, and everyone in the business – not only the finance or tax team – understands the steps they should take and the processes they need to follow in relation to tax matters.

Discover Forvis Mazars’ TCF service here: https://www.forvismazars.com/group/en/services/tax/tax-control-framework