If you’re UK based and considering becoming employee-owned, you may be interested in recent changes to EOTs announced in the 30th October 2024 budget. These adjustments affect the 0% Capital Gains Tax relief and are designed to prevent abuse without impacting the appeal of EOTs for most companies.

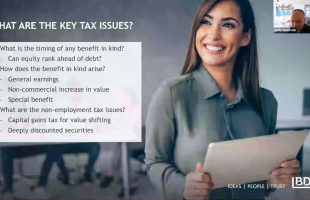

The changes, effective immediately, include:

- EOT trustees cannot be offshore.

- Less than 50% of trustees should be selling shareholders.

- Trustees must not pay over market value, requiring a professional valuation.

- An extended “disqualifying event” period—no event before the fourth tax year following the sale.

These measures affirm the government’s confidence in EOTs and the value they bring to companies, founders, and employees. With rising Capital Gains Tax rates ahead, selling to an EOT is now even more attractive compared to other exits.

If you’d like to explore this further, please reach out for a no-obligation conversation. You can find our contact details at www.postlethwaitesolicitorsco.com.

Postlethwaite Solicitors are a a niche boutique firm that specialises in Employee Ownership and has done for more than twenty years now, helping over 180 companies transition to employee ownership.