Recently, Martin Willis of the Society of Pension Professionals, (SPP), kindly shared some of his time with BusinessTV to help us all better understand Master Trusts.

Master Trusts have been around for some time now but it’s only since auto-enrollment that they’ve really taken off. Potentially, they can be used to outsource almost all of the administrative, governance and regulatory burdens that come with running your pension scheme. If the fit is right they can also offer strong economies of scale and high levels of investment expertise.

In this conversation we asked Martin some basic questions that we felt most of you would probably have, especially if you’ve not heard of these vehicles before.

We learnt that Master Trusts are not necessarily perfect for all types of schemes, or scheme cultures, but for many they are well worth a look.

We shall be publishing this interview shortly, so please look out for it as we’re certain you’ll find it useful.

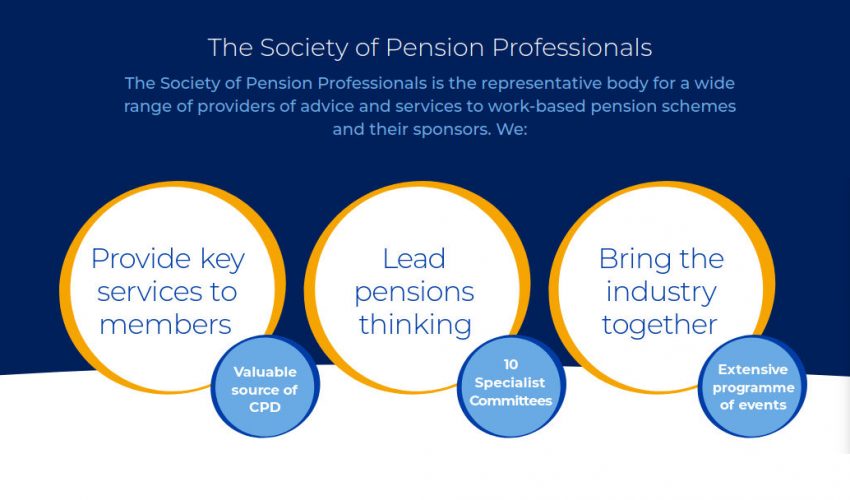

The Society of Pension Professionals

SPP is the representative body for a wide range of pension advisors and service providers.

Harnessing the expertise of its broad membership, SPP strives to deliver value to its members and improve how pensions work, positively impacting outcomes for pension scheme members, the pensions industry and its stakeholders.

The breadth of our membership profile is a unique strength for the SPP, including actuaries; lawyers; providers; consultants; administrators; investment managers; professional trustees and covenant assessors. Our members lead pensions thinking by working collaboratively, allowing views and knowledge to develop with a true breadth of perspective.

- Some 15,000 pension professionals working for SPP members

- Specialist committees bringing together over 120 pension professionals

- Regular engagement with politicians, policy makers, regulators and other influencers