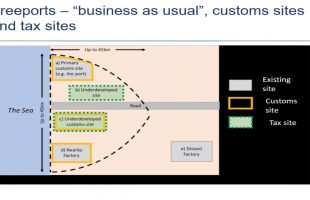

Do you feel prepared for Brexit? Do you understand yet how to manage the importing side of things as well continuing to trade in the EU effectively?

Ready or not, Brexit will bring significant changes to the way that businesses deal with VAT and Customs & Excise duties.

In this webinar our Tax and Customs experts both in the UK and the Netherlands provided advice to make sure you are ‘Brexit ready’. This webinar covered the key strategies for importing into the UK plus how you will be able be continue trading in the EU effectively and efficiently.

• Alison Horner, Indirect Tax Partner – Host and VAT matters

• Andrew Thurston, Customs Duty Consultant – Customs Duty and importing into the UK and EU post Brexit

• Marisa Hut, Manager VAT & Customs, Baker Tilly (Netherlands) NV – Clarifies the position in The Netherlands and VAT changes in the EU.

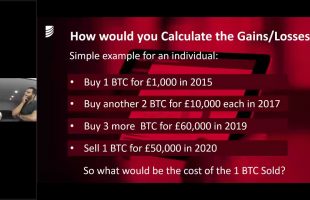

• Chris Danes, Tax Partner – The tax implications of doing business in the EU after Brexit.

• Richard Maitland, Partner – Employment tax issues affecting a workforce in the EU or coming to work in the UK

Find out more here: https://www.macintyrehudson.co.uk/spotlight-on/brexit-managing-risks-in-uncertain-times