Informal investigations take place when HMRC identify a risk that tax may have been lost and write to recipients asking that they provide information on a particular event or tax year. John Hood, Tax Partner at Moore Kingston Smith, outlines how you can resolve these matters whilst minimizing your exposure to interest and penalties.

If you would like any more information on how we can help with Tax Dispute Resolution, please get in touch pd@mks.co.uk.

Related Videos

Digital assets Part 3 – Further tax considerations and regulation

Haines Watts7212 views 8 November 2021

IoD South | Forward into uncertainty – Resilience in a shifting commercial landscape

IOD7279 views 20 October 2021

Employment tax and national minimum wage: In conversation with

Forvis Mazars13185 views 10 February 2023

The importance of the Quarterly Economic Survey

Thames Valley Chamber of Commerce5996 views 6 September 2024

Is rising inflation here to stay? > Market Update Q2 2022

Gardiner & Theobald4372 views 27 May 2022

Business BoardCast: How to unlock money from your balance sheet

Goringe Accountants3134 views 22 November 2021

Running a well-governed finance function- what’s the right mix?

Menzies12665 views 11 December 2023

Succession Planning – a step-buy-step guide to selling your business

Henderson Loggie5056 views 7 January 2022

FD Webinar series – part 2 of 4 financial reporting for planning & decision making

Menzies11300 views 19 February 2024

Investment Management Key Points for January 2022

Grupo de seguros de Zurich3136 views 27 January 2022

The Global Mobility Study – Annual Insights into the Future of Movement

L.E.K. Consulting11653 views 9 May 2023

Restructuring Video Series 2 | Creditor Pressure | Bishop Fleming

Bishop Fleming5398 views 5 January 2022

Digital assets Part 3 – Further tax considerations and regulation

Haines Watts7212 views 8 November 2021

IoD South | Forward into uncertainty – Resilience in a shifting commercial landscape

IOD7279 views 20 October 2021

Employment tax and national minimum wage: In conversation with

Forvis Mazars13185 views 10 February 2023

The importance of the Quarterly Economic Survey

Thames Valley Chamber of Commerce5996 views 6 September 2024

Is rising inflation here to stay? > Market Update Q2 2022

Gardiner & Theobald4372 views 27 May 2022

Business BoardCast: How to unlock money from your balance sheet

Goringe Accountants3134 views 22 November 2021

Running a well-governed finance function- what’s the right mix?

Menzies12665 views 11 December 2023

Succession Planning – a step-buy-step guide to selling your business

Henderson Loggie5056 views 7 January 2022

FD Webinar series – part 2 of 4 financial reporting for planning & decision making

Menzies11300 views 19 February 2024

Investment Management Key Points for January 2022

Grupo de seguros de Zurich3136 views 27 January 2022

The Global Mobility Study – Annual Insights into the Future of Movement

L.E.K. Consulting11653 views 9 May 2023

Restructuring Video Series 2 | Creditor Pressure | Bishop Fleming

Bishop Fleming5398 views 5 January 2022

Digital assets Part 3 – Further tax considerations and regulation

Haines Watts7212 views 8 November 2021

IoD South | Forward into uncertainty – Resilience in a shifting commercial landscape

IOD7279 views 20 October 2021

Employment tax and national minimum wage: In conversation with

Forvis Mazars13185 views 10 February 2023

The importance of the Quarterly Economic Survey

Thames Valley Chamber of Commerce5996 views 6 September 2024

Is rising inflation here to stay? > Market Update Q2 2022

Gardiner & Theobald4372 views 27 May 2022

Business BoardCast: How to unlock money from your balance sheet

Goringe Accountants3134 views 22 November 2021

Running a well-governed finance function- what’s the right mix?

Menzies12665 views 11 December 2023

Succession Planning – a step-buy-step guide to selling your business

Henderson Loggie5056 views 7 January 2022

FD Webinar series – part 2 of 4 financial reporting for planning & decision making

Menzies11300 views 19 February 2024

Investment Management Key Points for January 2022

Grupo de seguros de Zurich3136 views 27 January 2022

The Global Mobility Study – Annual Insights into the Future of Movement

L.E.K. Consulting11653 views 9 May 2023

Restructuring Video Series 2 | Creditor Pressure | Bishop Fleming

Bishop Fleming5398 views 5 January 2022

Search by Topics & Industries

Tim Hyatt, Head of UK Residential at Knight Frank The economics of Property

“Learn How To Say No” – Exporting Tips

Deleting data: what businesses need to know about data retention

What is the UK Export Academy?

Have You Considered Private Client Insurance?

The Pensions Regulator – Succeeding with automatic enrolment: Expert insights for advisers

Disputes Nightmares: What would you do if….a senior employee had stolen confidential information?

What comes first, vision or buy-in?

AI in 2024: Implementation, Productivity and Regulation

Selling Your Business > You’ll need the Right Team in Your Corner

Managing the Proceeds from Selling Your Business with Stuart Sanderson, Head of UK Private Clients at Brooks Macdonald

Popular

Preparing for Green Reforms: Impact on the retail sector

Mishcon de Reya LLP129152 views 18 July 2024

UK Foodstores: 5 things you should know

Knight Frank118477 views 18 March 2024

Expert Exporting with the British Chambers of Commerce

BusinessTV56943 views 15 October 2023

Selling Your Business > You’ll need the Right Team in Your Corner

BusinessTV53470 views 11 October 2023

Short Dated Government Bonds : An attractive alternative to Cash Deposits

BusinessTV48636 views 5 November 2024

Grow your Pension, Buy Commercial Property, Invest in your Business.

BusinessTV45197 views 29 September 2024

Managing the Proceeds from Selling Your Business

BusinessTV42604 views 1 September 2023

Have You Considered Private Client Insurance?

BusinessTV42069 views 18 October 2024

AIM for IHT

BusinessTV39750 views 22 January 2024

Free Financial Guidance and Support for your Employees

BusinessTV39683 views 21 July 2024

Use EIS To Tax-Efficiently Extract Profits From Your Business

BusinessTV38900 views 2 July 2024

Funding the Sale of Your Business to an Employee Ownership Trust

BusinessTV36469 views 22 October 2024

Understanding Master Trusts with the Society of Pensions Professionals

BusinessTV33676 views 20 July 2023

Price Increase Management for B2B Companies

Simon-Kucher & Partners31433 views 15 March 2022

Tom Stevenson’s Q4 Investment Outlook

Fidelity UK30764 views 13 October 2022

Retailer pricing strategies

Simon-Kucher & Partners29932 views 31 August 2022

ABL – Your Best Route to Raising Finance?

BusinessTV28581 views 11 November 2024

Planning for retirement – helping employees avoid pension-value destruction

BusinessTV28321 views 20 September 2023

Greenification of Transport Webinar – The future of clean mobility in Europe

Fieldfisher28083 views 17 August 2022

What the new government means for business

CBI25392 views 15 July 2024

Promotion effectiveness for consumer goods companies

Simon-Kucher & Partners25324 views 19 August 2022

The Wealth Report 2022

Knight Frank24825 views 8 April 2022

Winning With Emotion: How To Become Your B2B Customers’ First Choice

B2B International Market Research24521 views 1 November 2021

Addressing the legal and tax issues for employers for hybrid and remote working

Ince24464 views 11 November 2022

Looking beyond pay to help employees

Barnett Waddingham24280 views 20 December 2022

Trading with Latin America

Thames Valley Chamber of Commerce23898 views 20 October 2022

Work-related stress: supporting health and wellbeing at work

ACAS23646 views 10 November 2022

The secrets to successful sustainable marketing

The Chartered Institute of Marketing23516 views 24 August 2022

Employee Benefits: Are you communicating?

BusinessTV23323 views 18 September 2023

The best way to sell your business? Employee Ownership Trusts

BusinessTV22992 views 14 August 2023

*5* ways to future proof your business

Gerald Edelman22446 views 11 March 2024

Introductory webinar: Net Zero for UK businesses

The Carbon Trust22238 views 27 May 2022

The Power of People Reimagined – Workforce reporting transformation

PwC21730 views 16 September 2022

Incident responders, solving e-crime through digital forensics & cyber trends

Forvis Mazars21641 views 22 December 2022

ESG – the intersection with technology and assurance

Forvis Mazars20926 views 2 September 2022

Ian Stewart, Deloitte UK’s Chief Economist, provides an overview of macro-economic trends

Deloitte20801 views 22 September 2022

Time to talk about mental health at work

ACAS20767 views 17 March 2023

Retail in the Metaverse

Mishcon de Reya LLP20669 views 20 October 2022

Selling your business? Here are your options

Moore Kingston Smith LLP20620 views 4 August 2022

Using debt financing to grow your business

Saffery20499 views 7 December 2022

Search here

Latest Content

UK Spending review 2025

BaringaPartnersLLP18258 views 22hours ago

What’s the best way to build a network?

Deloitte7518 views 22hours ago

Market Update Q2 2025

Gardiner & Theobald9060 views 23 June 2025

Corporate transaction trends shaping the life sciences industry

Mills & Reeve5200 views 23 June 2025

Is this the secret to a happy retirement?

Fidelity UK11588 views 23 June 2025

Inheritance Provision for Family and Dependants Act

Wright Hassall7758 views 20 June 2025

Understanding the Value for Money Framework: A Joint Initiative for Pension Transparency

The Pensions Regulator8589 views 20 June 2025

How is tech helping leisure and hospitality businesses adapt?

RSM UK6564 views 19 June 2025

Introducing our 2025 Global M&A trends and risks report

Norton Rose Fulbright11380 views 19 June 2025

The evolution of Sales events – Mastering Sales & Negotiations

Huthwaite International13669 views 18 June 2025

Commercialisation of artificial intelligence

Gowling WLG5278 views 18 June 2025

How is my annuity calculated? | Annuities Explained

Legal & General11848 views 17 June 2025

Professional Services Tax Webinar – VAT Update 2025

BDO UK4875 views 17 June 2025

AI Agents, Machine Customers and the Future of Customer Experience

Gartner6891 views 16 June 2025

Alternative Markets Unlocked: Flanders as Your Gateway to the EU

Thames Valley Chamber of Commerce9264 views 16 June 2025

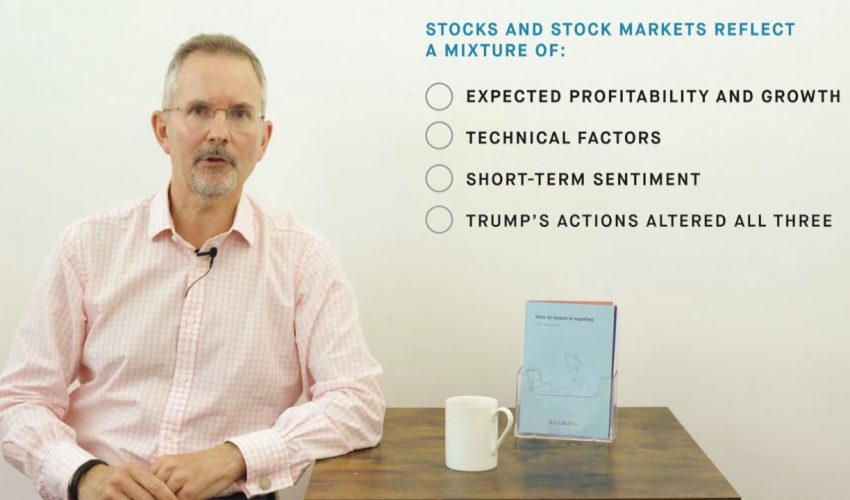

Investing under Trump, part three – why stock market volatility is here to stay

Killik & Co10718 views 13 June 2025

The Ground Rules – Red Bricks Rising: Labour’s Housing Pledge Unpacked

Shakespeare Martineau7289 views 13 June 2025

Overcoming data challenges

REBA - Reward & Employee Benefits Association4877 views 13 June 2025

UK Consumer Spending – insights by Caspian Conran

BaringaPartnersLLP6287 views 12 June 2025

How can organisations create purposeful supply chains in the consumer sector?

Forvis Mazars8872 views 12 June 2025

Energy Prices, Industrial Strategy & Spending Review | Making News – May 2025

Make UK - The Manufacturers' Organisation15900 views 11 June 2025

Failure to prevent fraud – Impact on tax investigations

Osborne Clarke6572 views 11 June 2025

Rise of the Robots

DLA Piper8973 views 10 June 2025

Avoiding scams, deepfakes and cyber attacks

Hargreaves Lansdown3581 views 10 June 2025

Rebuilding Your Digital Presence : Webinar Express

The Chartered Institute of Marketing12861 views 10 June 2025

The battle between tech and fraud

RSM UK10408 views 9 June 2025

As tariffs reshape construction, smart pricing is your strongest foundation

Simon-Kucher & Partners4856 views 9 June 2025

The three things to get right when scaling beyond proof of concept

BaringaPartnersLLP6208 views 6 June 2025

Digital enablement of physical in manufacturing

Capgemini8747 views 6 June 2025

Statutory Sick Pay Changes: Tackling potential rises in short term sickness

HR Solutions5199 views 6 June 2025

What are the types of annuity? | Annuities Explained (Episode 2)

Legal & General6287 views 5 June 2025

Managing conflict in the workplace

ACAS3869 views 5 June 2025

How to keep your emails safe from hackers

Thames Valley Chamber of Commerce11690 views 4 June 2025

Killik & Co’s Market Update: 30th May

Killik & Co12871 views 4 June 2025

Building Antifragile Organizations for the Future

Gartner9594 views 3 June 2025

What do we need to learn about learning at work?

Deloitte5942 views 3 June 2025

An overview of cashflow forecasting

Azets UK11837 views 2 June 2025

Premium Bonds – Should you ever buy them?

Fidelity UK8335 views 2 June 2025

Using AI to drive business efficiency & insight

Moore Kingston Smith LLP12614 views 30 May 2025

Workplace Evolution – Navigating Tomorrow

BDO UK6771 views 30 May 2025

Beat money anxiety: managing your money and retirement in uncertain times

Hargreaves Lansdown8144 views 29 May 2025

EU Digital Decade

DLA Piper5130 views 29 May 2025

Occupational Trends | The Market in Minutes

Savills11830 views 28 May 2025

The rise of AI innovation

BJSS Ltd4412 views 28 May 2025

Pascal Prevost on working with HR and procurement teams to optimise benefits funding

REBA - Reward & Employee Benefits Association7360 views 27 May 2025

Bridging digital continuity and augmented intelligence

Capgemini6402 views 27 May 2025

UK private equity outlook | Behind the Transaction podcast

Grant Thornton16630 views 26 May 2025

Key challenges in negotiating for AI in Digital Transformation

Fieldfisher4328 views 26 May 2025

FRS 102: understanding operating leases

KPMG UK10750 views 23 May 2025

How the Employment Rights Bill is progressing

Chartered Institute of Personnel and Development7734 views 23 May 2025

How will tariffs affect credit risks?

Allianz Trade14369 views 22 May 2025

Electric Customer Service

Accenture UK4730 views 22 May 2025

The truth about offshore trusts: Key considerations you can’t ignore

Gerald Edelman10209 views 22 May 2025

Essential tax strategies for the property and construction sector webinar

Menzies13183 views 21 May 2025

FRS 102: Understanding the changes

Kreston Reeves6369 views 21 May 2025

Financing new energy and infrastructure

HSBC7204 views 21 May 2025

Q1 Wrapped: CIOs, Where Are Your 2025 Resolutions Now?

Gartner10638 views 20 May 2025

Implementing platform based technology in the public sector: one thing you wish people knew

BaringaPartnersLLP3582 views 20 May 2025

Industry-wide reflections: Shaping today’s mortgage market

Legal & General8282 views 19 May 2025

Passive investing – are we doing it all wrong?

Fidelity UK9344 views 19 May 2025

ESG: What is governance and why is it important?

Mills & Reeve6335 views 16 May 2025

Retail Hot Topics

BDO UK14386 views 16 May 2025

Workforce Impact of AI Session

DLA Piper6539 views 15 May 2025

Management Buy-Outs: What’s it all about? | Menzies LLP

Menzies4738 views 15 May 2025

Defining categories of workers ready for the EU Pay Transparency Directive

Willis Towers Watson4838 views 14 May 2025

Understanding Making Tax Digital for Income Tax

Azets UK13493 views 14 May 2025

How to invest in volatile markets – part one

Killik & Co11489 views 13 May 2025

Redundancy in 2025 – Prevention, process and key steps for a smooth transition for all parties

HR Solutions8751 views 13 May 2025

Non-Executive Directors – Succeeding in Sustainability: Beyond the Here and Now

BDO UK6350 views 12 May 2025

Quick Win – From technical experts to commercially effective salespeople

Huthwaite International13685 views 9 May 2025

EU design reform

Gill Jennings & Every LLP7414 views 9 May 2025

EMERGENCY FUNDcast – SORP’s Up: Navigating charity financial reporting changes

Larking Gowen4977 views 8 May 2025

People Matter: employment law update

Mills & Reeve10198 views 8 May 2025

Perspectives: Bonds and Currencies

HSBC11567 views 7 May 2025

Mandatory Payrolling of Benefits in Kind

Henderson Loggie6222 views 7 May 2025

What Investors Are Saying About Geopolitics At The Milken Global Conference

Oliver Wyman5388 views 7 May 2025

Update & live demo of our upcoming ‘One IPO’ patents service with CIPA

Intellectual Property Office UK8386 views 6 May 2025

The Future of Health and Protection Research 2025 insights with REBA’s Debi O’Donovan

REBA - Reward & Employee Benefits Association6394 views 6 May 2025

AI Workplace Drama?! The Behavioral Outcomes That Matter

Gartner8403 views 6 May 2025

How can treasury advisory help consumer businesses thrive?

Forvis Mazars13080 views 2 May 2025

The UK’s whole life carbon ecosystem: a framework for decarbonising the built environment.

Royal Institution of Chartered Surveyors (RICS)4621 views 2 May 2025

Investor Insights – Martin Connaghan & Samantha Fitzpatrick, Murray International Trust

Killik & Co6476 views 1 May 2025

Hong Kong Market Outlook: Market and Industry Outlook 2025

Jones Lang Lasalle8302 views 1 May 2025

The 3Cs of Responding to Ransomware Attacks

Latham & Watkins11776 views 30 April 2025

Tariff-ied Markets : Taking Stock – After The Bell:

Quilter Cheviot6393 views 30 April 2025

Are you ready for ‘failure to prevent fraud’?

Osborne Clarke8888 views 29 April 2025

Tax Governance, Risk and Compliance

BDO UK6354 views 29 April 2025

The benefits of Flow for Asset Management clients

Legal & General8746 views 28 April 2025

US Tariffs and Impact on UK Trade

Thames Valley Chamber of Commerce13402 views 28 April 2025

Disputes Nightmares: What would you do if your Board was subjected to a deepfake fraud scam?

Mishcon de Reya LLP7713 views 28 April 2025

The countdown to T+1 accelerated settlement

PwC6915 views 25 April 2025

Navigating Tariffs: legal considerations for UK business

Gowling WLG14447 views 24 April 2025

Life Sciences Legal Forum

Mills & Reeve5210 views 24 April 2025

Exit permutations, aspirations and valuations

Moore Kingston Smith LLP11810 views 23 April 2025

Preparing for the 2025/26 tax year – April 2025

Forvis Mazars4770 views 22 April 2025

Trump backs down on tariff hike : Patrick’s update

Charles Stanley8288 views 22 April 2025

Defining Roles & Bringing Clarity to Your Team

The Chartered Institute for IT3825 views 22 April 2025

Four financial planning mistakes worth avoiding

Killik & Co13675 views 17 April 2025

Overcoming ‘Disco Fever’ – Making digital transformation in the public sector more impactful

BaringaPartnersLLP6207 views 16 April 2025

From tech talk to revenue: Turning technical expertise into sales success

Huthwaite International12247 views 16 April 2025

Enabling the Hybrid Generation to Flourish

British Standards Institution (BSI Group)7487 views 16 April 2025

Spring Statement 2025: Business Tax Changes

Carpenter Box15818 views 15 April 2025

Maximising ERP success: How tax teams can drive transformations

KPMG UK9769 views 15 April 2025

Cover Talk: Accident and health insurance – key misconceptions uncovered and clarified

Mills & Reeve11859 views 15 April 2025

Are data centres Nationally Significant Infrastructure Projects?

DLA Piper4841 views 15 April 2025

The AI Technology Outcomes That Matter for 2025

Gartner6188 views 14 April 2025

Are you a Geostrategist?

EY UK&I7292 views 11 April 2025

Spring Statement Review

Brooks Macdonald8516 views 11 April 2025

Markets Bulletin: Trade war turbulence

Killik & Co11804 views 10 April 2025

What’s left after 10 years of pension income?

Fidelity UK16926 views 10 April 2025

Understanding VAT and SDLT in property deals

Larking Gowen8761 views 10 April 2025

Navigating labour, employment and compensation challenges in global M&A: Post-deal integration

Mishcon de Reya LLP7916 views 9 April 2025

The evolving PRT market

Legal & General14168 views 8 April 2025

The impact of new tech regulations on digital transformation

Fieldfisher6658 views 8 April 2025

What does it take to turn things around?

Deloitte4225 views 7 April 2025

Calculating Annual Leave and Entitlement – New rules and legal changes

HR Solutions6731 views 7 April 2025

Defined benefit funding code webinar – what you need to know

The Pensions Regulator8763 views 4 April 2025

The Future of Property Planning and Development : RICS Tech Partner Panel Discussion:

Royal Institution of Chartered Surveyors (RICS)5371 views 3 April 2025

Are insurers ready for IFRS S1 and IFRS S2 implementation?

Forvis Mazars6447 views 2 April 2025

BDO Manufacturing Outlook Webinar | Q1 2025

BDO UK16910 views 2 April 2025

Quick Win – Aligning Sales & Marketing for Maximum Impact

Huthwaite International12849 views 1 April 2025

Risk & Regulation Rundown: Inside the FCA’s new strategy

PwC16788 views 1 April 2025

Unlocking growth, insights from our CEOs

Simon-Kucher & Partners6613 views 31 March 2025

Weekly Market Update: 28th Mar

Killik & Co10083 views 31 March 2025

Investment opportunities in green hydrogen

Osborne Clarke6294 views 28 March 2025

Having a Whale of a Time : Taking Stock – After The Bell: Having a Whale of a Time

Quilter Cheviot9723 views 28 March 2025

Managing rising employment costs: essential tips for tax leaders

KPMG UK8733 views 27 March 2025

How to get your people and financials exit ready

Moore Kingston Smith LLP12774 views 27 March 2025

Calculating VAT recovery for independent schools

Larking Gowen4575 views 27 March 2025

Market Update Q1 2025

Gardiner & Theobald12967 views 26 March 2025

Cyber Security: Blueprint Podcast Featuring Ali Farooqui

BJSS Ltd5838 views 26 March 2025

The Private Office: Market Spotlight

Savills13725 views 25 March 2025

Navigating AI Inventorship

Chartered Institute of Patent Attorneys6303 views 25 March 2025

What can investments help to achieve?

LGT Wealth Management12754 views 24 March 2025

Pillar Two: The Global Minimum Tax

BDO UK9287 views 21 March 2025

Building a unified employee proposition for a multi-generational workforce

REBA - Reward & Employee Benefits Association8689 views 21 March 2025

Guardian Agents: The Next Evolution in AI Oversight

Gartner16588 views 21 March 2025

National Minimum Wage in retail

Forvis Mazars18485 views 20 March 2025

‘Gems’ of Employment Law – Ep 1

Wright Hassall4936 views 20 March 2025

Why is my pension performing poorly? Common concerns explained

Carpenter Box12962 views 20 March 2025

Does AI’s Limit Exist? – S5: Tech Vision

Accenture UK10655 views 19 March 2025

What’s the secret to doing our best work?

Deloitte7482 views 18 March 2025

Navigating Tariffs: What Industrial and B2B Companies Need to Know

Simon-Kucher & Partners6371 views 18 March 2025

The Online Safety Act: Key issues, practical tips and next steps — Q&A event with Ofcom

Fieldfisher11067 views 17 March 2025

The Ground Rules – Affordable Housing

Shakespeare Martineau7450 views 17 March 2025

How to (really) be a contrarian investor

Fidelity UK13797 views 14 March 2025

How to keep your IP secrets

Withers & Rogers8716 views 14 March 2025

A Consumer Law Gamechanger : LathamTECH in Focus:

Latham & Watkins12069 views 13 March 2025

How to optimise cash taxes amid rising costs

KPMG UK13040 views 13 March 2025

Succeeding with artificial intelligence

Osborne Clarke6971 views 12 March 2025

Inheritance tax changes and the impact on family-owned businesses

Saffery12833 views 12 March 2025

Taking Stock – After The Bell: Deepseek, AI, and Economic Cycles

Quilter Cheviot7053 views 12 March 2025

Kreston UK Academies Benchmark Report 2025

Duncan Toplis5418 views 11 March 2025

What makes AI a critical topic for business now?

Chartered Institute of Personnel and Development4654 views 11 March 2025

Killik & Co’s Weekly Market Update

Killik & Co8481 views 11 March 2025

FS in Focus: Resilience in the face uncertainty

BaringaPartnersLLP4774 views 10 March 2025

Compliance & Risk – Eps 1: Introduction

Shoosmiths4729 views 7 March 2025

Why is it crucial for women to take charge of their financial journey?

Brooks Macdonald13323 views 7 March 2025

AI Is The New Fire; Don’t Get Burned

B2B International Market Research3877 views 6 March 2025

Neurodiversity at Work

ACAS5286 views 6 March 2025

New rights – what employers need to know

Moore Kingston Smith LLP8405 views 6 March 2025

UK FinReg Focus Areas in 2025: Wholesale Markets

Latham & Watkins3561 views 5 March 2025

Are you really listening? Unlocking innovation and engagement in the workplace

IOD6485 views 5 March 2025

Making News 2025

Make UK - The Manufacturers' Organisation13953 views 4 March 2025

Consumers in the driver’s seat: The demand revolution

Simon-Kucher & Partners16881 views 4 March 2025

Evolving financial advice in pursuit of customers’ best interests

Legal & General7018 views 3 March 2025

Climate contracting in real estate

Royal Institution of Chartered Surveyors (RICS)3063 views 3 March 2025

Should You Transfer Your Pension?

Carpenter Box8795 views 28 February 2025

Employers’ Year End Special

BDO UK16501 views 28 February 2025

They Aren’t Chatbots! What AI With Agency Can Do for You

Gartner12898 views 27 February 2025

Four factors that could unsettle stocks in 2025

Killik & Co8781 views 27 February 2025

Quick Win – Mastering Sales and Negotiations

Huthwaite International9902 views 26 February 2025

A Beginner’s Guide to… Employer Covenant

The Society of Pension Professionals3731 views 26 February 2025

Unlocking the Secrets to 2025 Success: HR Strategies that Drive Growth!

BeyondHR5580 views 26 February 2025

Payroll Transformation │ Turning risks into value opportunities

KPMG UK6901 views 25 February 2025

What are Trade Secrets

Withers & Rogers8802 views 25 February 2025

Market Moves – 21 February 2025

Charles Stanley10535 views 24 February 2025

Make UK – Energy Procurement Webinar

Make UK - The Manufacturers' Organisation6552 views 24 February 2025

Pricing as a leadership lever: Driving growth from the boardroom

Simon-Kucher & Partners11496 views 21 February 2025

Sack the PR Department! – Taking Stock – After The Bell

Quilter Cheviot8828 views 21 February 2025