Marc Harris talks to Stewart Sanderson of Brooks Macdonald about the value of quality Wealth Management in helping the Company Director clarify their personal goals in tandem with the goals they have for selling their business. Stewart explains how their experience can help a Business Owner make clear forecasts for their lifestyle, ‘post sale’, and ensure they have a robust plan in place to help grow and protect money and assets for themselves and their family.

Use the Chapter links below to travel to specific places in the conversation

Introduction:Brooks Macdonald and my guest Stewart Sanderson head of Private Clients

Ch 1. How prepared are company directors for this sort of liquidity event?

Ch 2. Does coming into funds in this way bring about any immediate considerations?

Ch 3. What are you looking to learn from the client during the discovery process?

Ch 4. It makes sense to begin a relationship with yourselves as early as possible?

Ch 5. My questioning would be around, you know, who’s advising you corporately?

Ch 6. Did you often find that attitudes change once specific scenarios are considered?

Ch 7. Getting everything out on the table, bank accounts, premium bonds, legacy pension, ISA, life policy…

Ch 8. What does wealth management look like in terms of specific products and strategies?

Ch 9. I imagine quite a large part of your work is asset protection and succession planning?

Ch 10. But unintended consequences of one decision have a knock-on effect somewhere else.

Ch 11. Who are Brooks Macdonald best able to assist?

Ch 12. What does on on-going relationship look like?

Please get in touch with Stewart and his team using this form

- By clicking the “Submit” button above, you acknowledge that we will use your information as set-out in the Brooks Macdonald Privacy Notice

Stewart joined Brooks Macdonald in July 2020 to lead the UK Private Clients proposition. He is responsible for developing the UK Private Clients business by shaping and delivering the growth strategy. Additionally, he continues to advise several key clients primarily from sporting, corporate and entrepreneurial backgrounds with their broader wealth management needs.

Stewart has over 25 years’ experience of UK wealth management gained at institutions such as Lloyds Private Banking and Coutts & Co. Prior to joining Brooks Macdonald, Stewart was Managing Director at 7IM LLP, where he initially led their UK discretionary management business, before developing and leading their UK private clients business across London, Edinburgh and Jersey.

Stewart holds several industry qualifications and is a Fellow of the Chartered Institute for Securities & Investment (Chartered FCSI).

With us, it’s personal

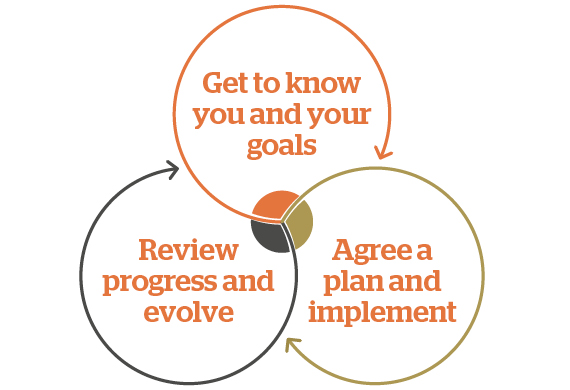

Your dedicated private client manager will take the time to get to know you, your family and your goals. They’ll help guide you through life’s key financial milestones.

30 years of word-of-mouth recommendations

Multiple generations of the same families have stayed with us and recommended us to others. We’re proud to help the next generation build their own legacy.

The team behind the team

You’ll benefit from a hugely experienced and knowledgeable wealth management team behind the scenes. They’ll focus on making the complex simple, giving you clarity when it comes to your wealth.

Learn more from these short videos presented by members of the Private Clients team

Planning your retirement

Growing your wealth

Getting your estate in order

Protecting your wealth from the unexpected

Managing your income in retirement

What is wealth management?

Important information

Investors should be aware that the price of investments and the income from them can go down as well as up and that neither is guaranteed. Investors may not get back the amount invested. Past performance is not a reliable indicator of future results. Changes in rates of exchange may have an adverse effect on the value, price or income of an investment. Tax treatment depends on individual circumstances and may be subject to change in the future, so you should seek independent tax advice, as to your own position. The information does not constitute advice or a recommendation and you should not make any investment decisions on the basis of it.