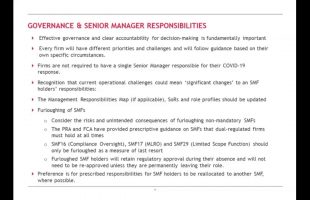

Cases are progressed under HMRC’s Code of Practice 9 (COP9) procedure where HMRC either suspect, or the individual chooses to voluntarily disclose, that their deliberate action or inaction has led to an insufficient amount of tax being paid. HMRC refer to such behaviour as “tax fraud” but this is more commonly referred to as tax evasion.

If you would like to learn more or discuss COP9 in more detail, whether it is right for you or your clients, please do contact Menzies Tax Disputes and Disclosures Team on our website: https://www.menzies.co.uk/what-is-cod…