The way in which VAT is charged on construction services will change on 1 March 2021.

This change was originally planned for 1 October 2019 but is now coming into place next month, with around half of UK construction businesses expected to be affected.

WHY ARE NEW RULES NEEDED?

HMRC believe £100m of revenue is lost each year as a result of ‘missing-trader’ fraud. This is where construction businesses charge VAT to their customers and then disappear before paying it over to HMRC. To combat this type of fraud, new ‘reverse charge’ rules will come into force on 1 March 2021, which will have a widespread impact on the construction sector.

HOW WILL THE NEW RULES WORK?

Under the new rules, businesses supplying construction services must not charge VAT where their customer is registered for VAT and will use the services to make an onward supply of construction services.

Instead of the supplier charging VAT, the recipient of the services must self-account for VAT on the services received. This is known as ‘reverse charge’ accounting.

Sarah Barron, our property VAT specialist will provide an update on the changes to VAT in the construction sector, followed by a Q&A session. To maximise the chances that your question is answered, please enter this when responding to this invitation.

Sarah will cover:

1. When you must use the reverse charge

2. When you must not use the reverse charge

3. How the charge works if you supply services

4. How the charge works if you buy services

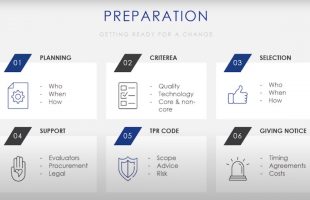

5. Planning for the reverse charge:

Accounting systems and software

Impact on cashflow

Upskilling staff